Market Recap

On Wednesday, spot gold traded near $4,210.94/oz, surging past the $4,200 mark to a fresh record high of $4,218.14/oz. The rally was fueled by strong rate-cut bets and geopolitical tensions, drawing investors toward safe-haven assets. Meanwhile, US crude hovered near $58.18/bbl, with gains capped by escalating trade frictions and IEA warnings of a potential global supply surplus by 2026.

Gold

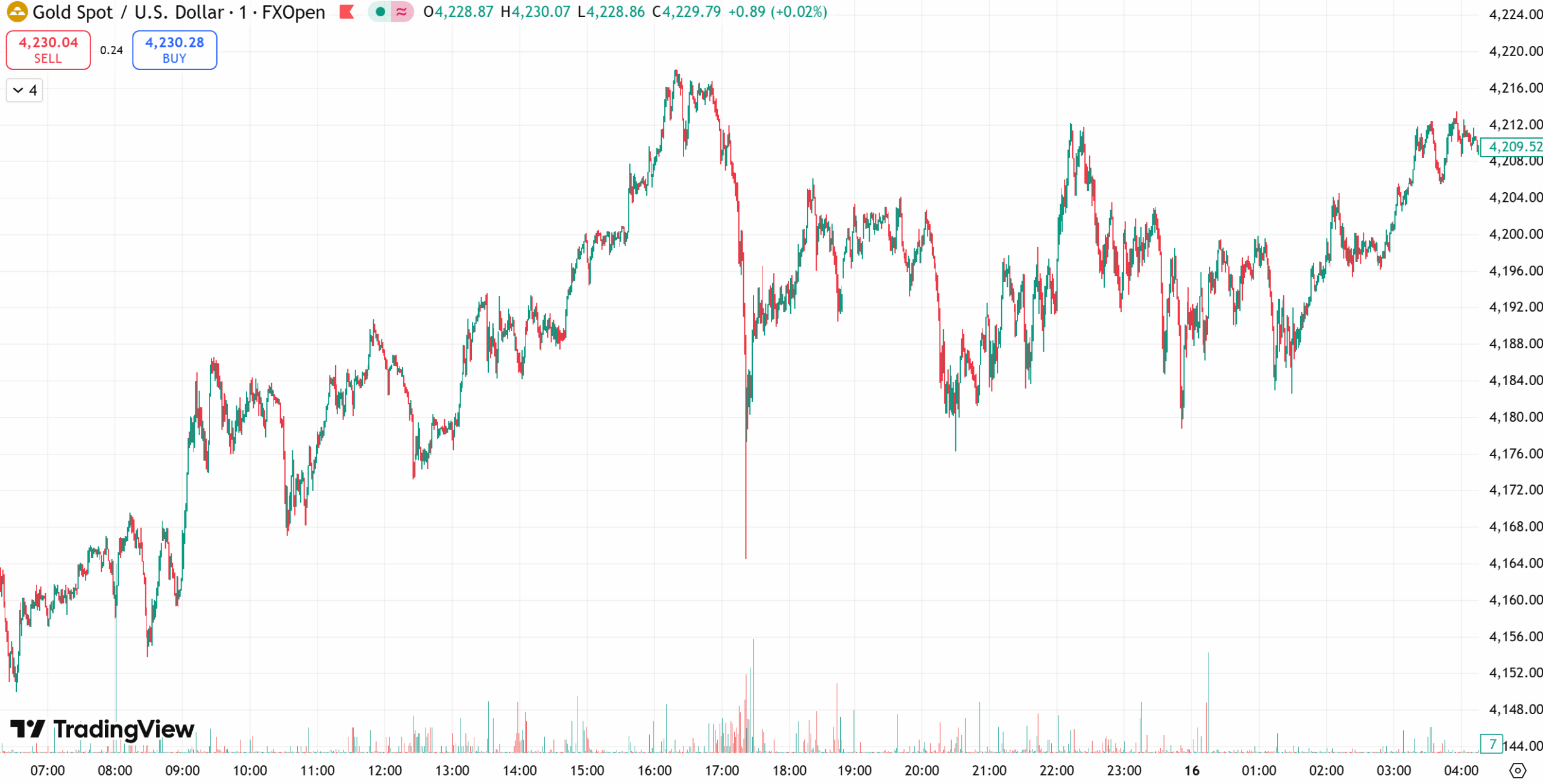

Gold extended its record-breaking rally Wednesday, surpassing $4,200/oz for the first time as dovish Fed expectations and renewed geopolitical uncertainty boosted demand for the metal.

Fawad Razaqzada, Market Analyst at City Index and FOREX.com, said: “Gold just keeps climbing — and doesn’t seem ready to stop. With trade tensions flaring up again, investors have every reason to hedge their equity exposure through gold.”

Year-to-date, gold has soared over 60%, supported by rate-cut bets, geopolitical risk, central bank buying, ETF inflows, and the ongoing de-dollarization trend.

Razaqzada added, “We’re just $800 away from $5,000, and I wouldn’t bet against gold reaching that level.”

Fed Chair Jerome Powell’s dovish comments on Tuesday, noting that the US labor market remains in a “low hiring, low momentum” phase, weighed on the dollar, further supporting gold.

Traders now price in a 98% chance of a 25 bps rate cut in October and 100% odds of another in December.

Technical outlook: Gold opened with a strong upward move, breaking $4,180 and extending to $4,218/oz before a sharp pullback to $4,165, where it found solid support. The recovery into the US session reclaimed all losses, with bullish momentum still dominant. The stacking of strong bullish candles suggests that any near-term correction may remain shallow.

Today’s Outlook:

- Strategy: Buy on pullbacks, sell on rebounds

- Resistance: $4,220 – $4,240

- Support: $4,180 – $4,160

Crude Oil

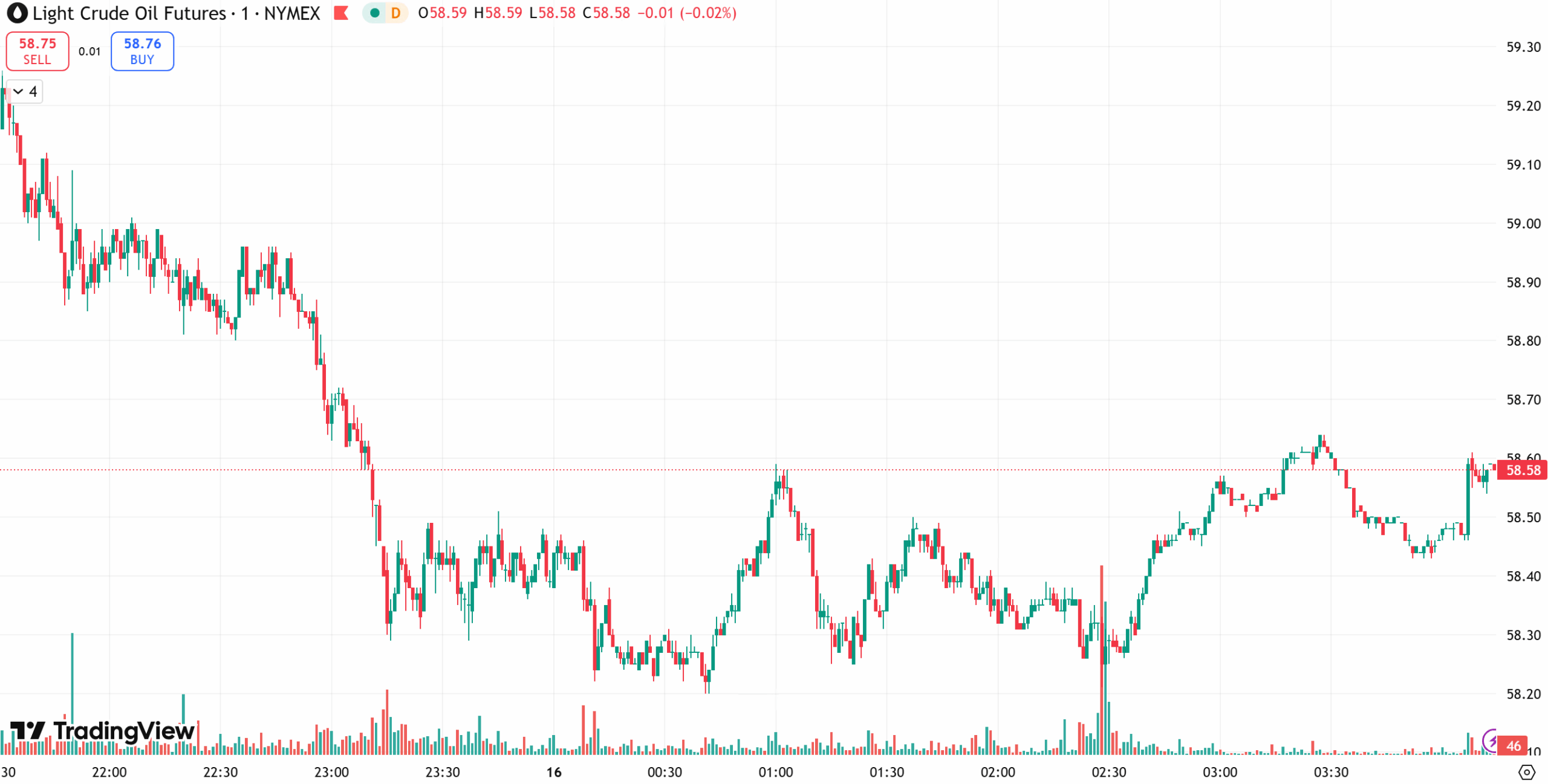

Oil prices were muted Wednesday as trade tensions intensified and the IEA maintained its forecast of a major supply surplus by 2026.

According to Bank of America, if trade disputes escalate while OPEC+ output continues rising, Brent crude could drop below $50/bbl.

Last week, renewed trade friction between the world’s two largest economies over port tariffs raised concerns about disruptions to global shipping.

Fed Governor Stephen Miran warned that rekindled trade tensions pose a “material downside risk” to the economy, making rate cuts increasingly critical to support growth and oil demand.

Meanwhile, Chicago Fed data showed US retail sales (excluding autos) likely grew further in September, partly reflecting higher prices.

Technical outlook: On the daily chart, oil remains in a clear downtrend, with MACD lines diverging below zero and bearish momentum dominant. Short-term charts show continued weakness, as oil hit a new low near $57.30/bbl before a mild rebound. Moving averages remain downward-sloping, signaling persistent selling pressure.

Today’s Outlook:

- Strategy: Sell on rebounds, buy on dips

- Resistance: $60.0 – $61.0

- Support: $57.0 – $56.0

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.