During early Asian trading on Tuesday, spot gold hovered near $4,454 per ounce, after climbing to a one-week high on Monday. Silver, platinum, and other precious metals also moved higher across the board, supported by rising geopolitical risks following US military action against Venezuela. Meanwhile, WTI crude traded near $58.16 per barrel, with oil prices up nearly 2% as traders assessed the potential impact of the arrest of Venezuelan President Nicolás Maduro on global oil supply, while also keeping an eye on a series of key US economic data releases due later this week.

Gold

On Monday, gold prices rose to a one-week high, driven by heightened geopolitical risks stemming from US military action against Venezuela. Silver, platinum, and other precious metals also posted broad-based gains.

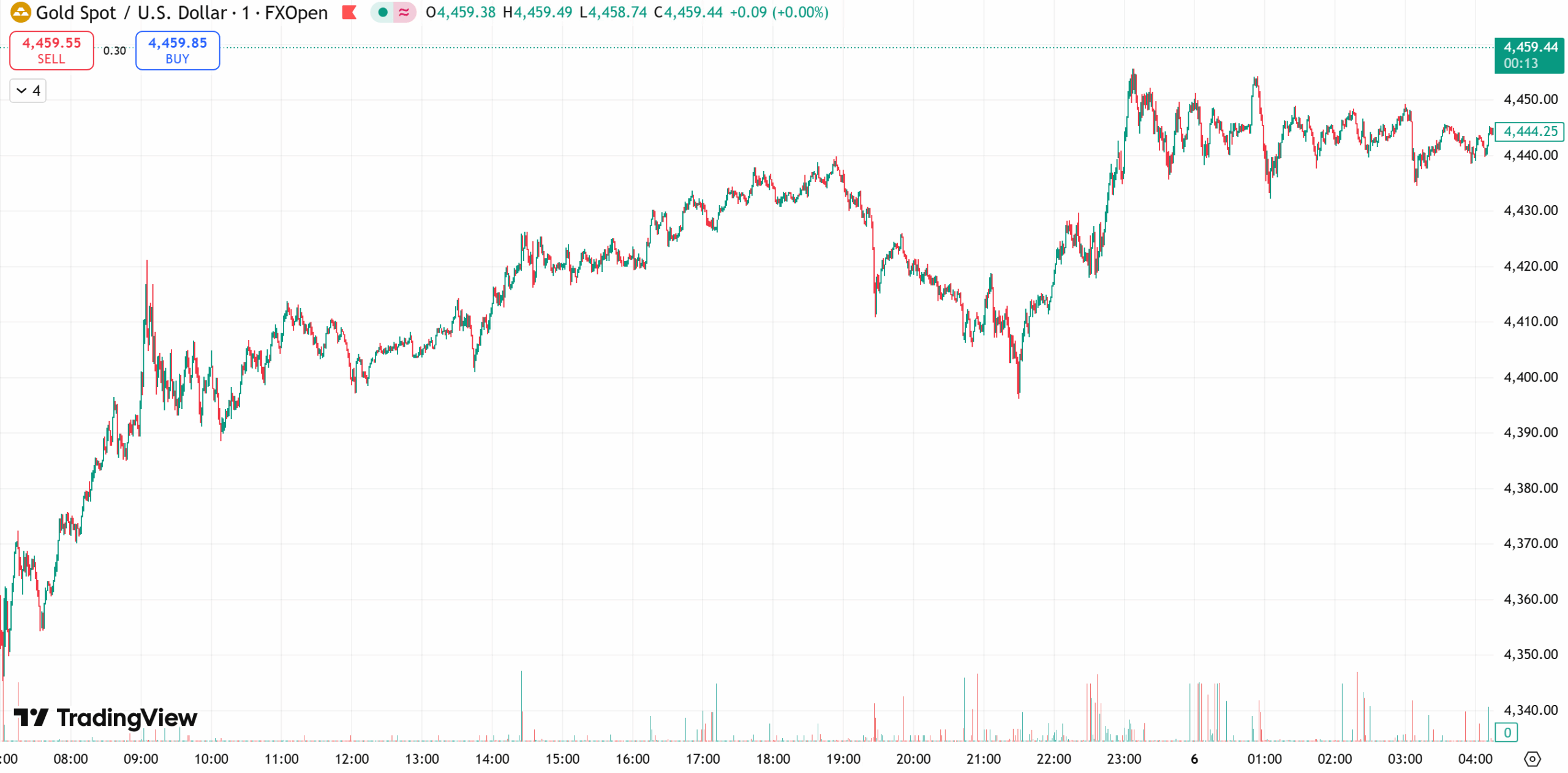

Spot gold surged 2.7% to $4,444.52 per ounce, marking its highest level since December 29. US gold futures for February delivery rose 2.8%, settling at $4,451.50 per ounce. Previously, gold had hit a record high of $4,549.71 per ounce on December 26, 2025.

Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany, noted that developments in Venezuela had clearly reignited safe-haven demand. However, he added that markets had already been grappling with broader concerns surrounding geopolitics, energy supply, and monetary policy. He emphasized that if geopolitical tensions escalate further, or if upcoming US economic data strengthens expectations for more aggressive Federal Reserve easing, gold could once again challenge its record highs.

Gold Technical Analysis:

Gold continues to post higher highs, with prices holding above the middle Bollinger Band and moving averages trending upward, reinforcing a bullish bias. For the near term, the $4,400 level remains a key support zone. As long as prices hold above this threshold, upside momentum is likely to persist. On the upside, resistance is seen around $4,480, and a clear break above this level could pave the way for another test of record highs.

Today’s Focus:

Trading strategy favors buying on pullbacks, with short-term selling on rallies as a secondary approach.

- Upside resistance: $4,460–$4,480

- Downside support: $4,420–$4,400

Oil

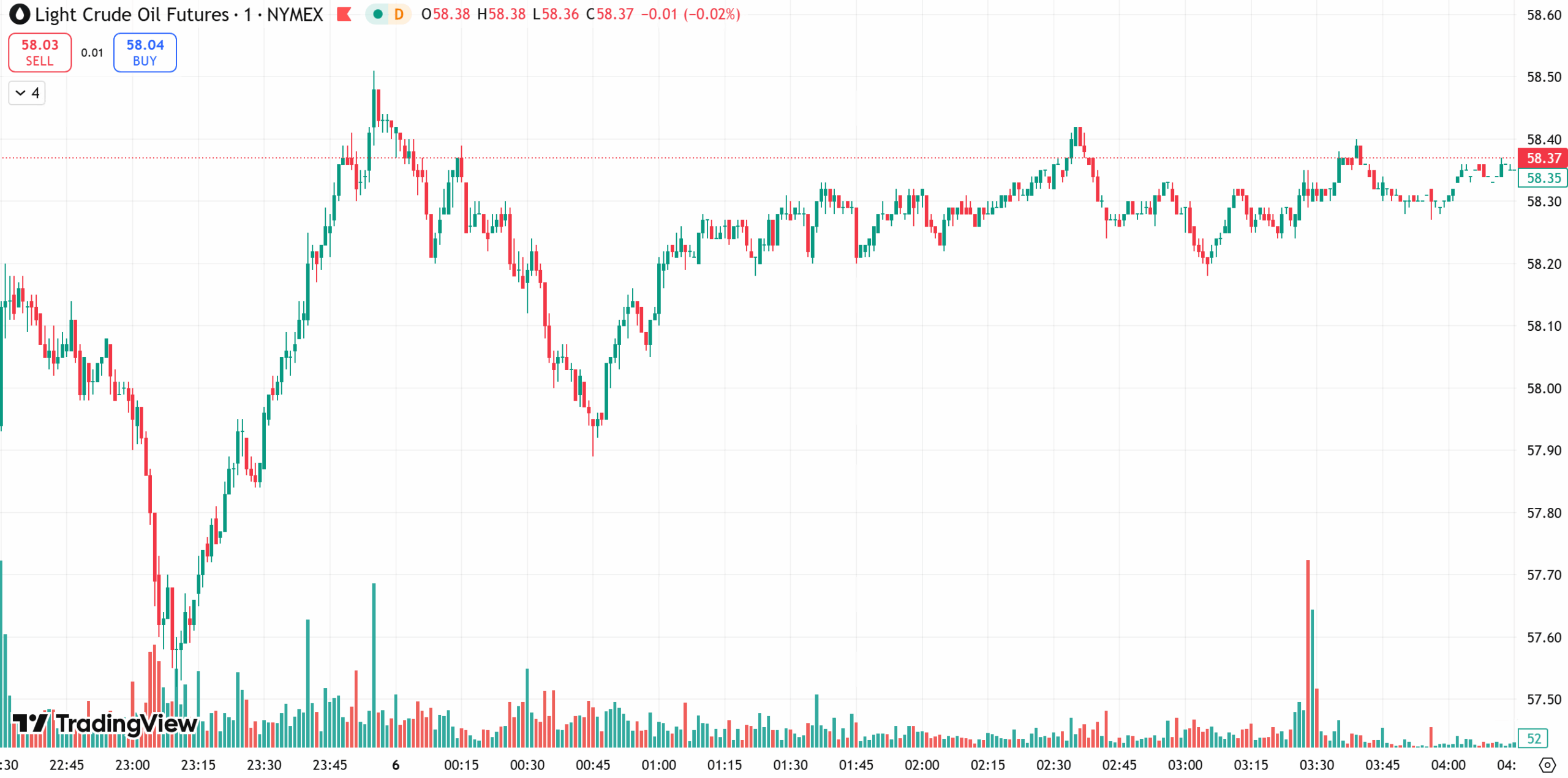

Oil prices climbed nearly 2% on Monday, as traders evaluated the potential impact of the US arrest of Venezuelan President Nicolás Maduro on global oil supply. By the close, Brent crude rose 1.66% to $61.76 per barrel, while WTI gained 1.74% to $58.32 per barrel.

Markets are digesting the news of Maduro’s arrest and the possibility that Washington could take control of the OPEC member’s oil sector. The US embargo on Venezuelan crude exports remains in place, keeping the country’s oil flows firmly in focus.

Analysts at Aegis Hedging noted that the key uncertainty lies in how US actions may alter Venezuelan crude movements. Industry sources revealed that the Trump administration did not consult major oil companies such as ExxonMobil, ConocoPhillips, or Chevron before or after the military action, though meetings are expected later this week. One executive commented that, aside from Chevron, which already operates in the country, other firms are unlikely to commit to immediate development efforts.

Venezuela’s interim president has expressed willingness to cooperate with the US. Simon Wong, portfolio manager at Gabelli Funds, said he expects any maritime blockade to be lifted eventually, with sanctions likely to be removed over time. This could allow large volumes of Venezuelan crude currently stranded at sea or in bonded storage to return to the market, though a meaningful increase in production would take time.

Technical Analysis:

On the daily chart, oil entered a consolidation phase after testing the $54.80 area. Prices remain capped by downward-sloping moving averages, keeping the medium-term trend biased to the downside. In the short term, WTI retested the $56.60 low on the hourly chart, forming a long lower shadow that signals buying interest at lower levels. With mixed signals between short-term and medium-term trends, oil prices may attempt a rebound, with $59 acting as a key resistance level.

Today’s Focus:

Strategy favors buying on dips, with selling on rallies as a secondary option.

- Upside resistance: $59.5–$60.5

- Downside support: $57.0–$56.0

Risk Disclosure

Trading Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time. You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us.

When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.