On Thursday, spot gold traded near 4167.57 dollars per ounce, extending its rally and climbing to a more than one-week high as markets strengthened their expectations for a Federal Reserve rate cut next month.

WTI crude traded near 58.50 dollars per barrel, inching up from a one-month low as investors weighed oversupply concerns against progress in Russia-Ukraine peace talks ahead of the Thanksgiving holiday.

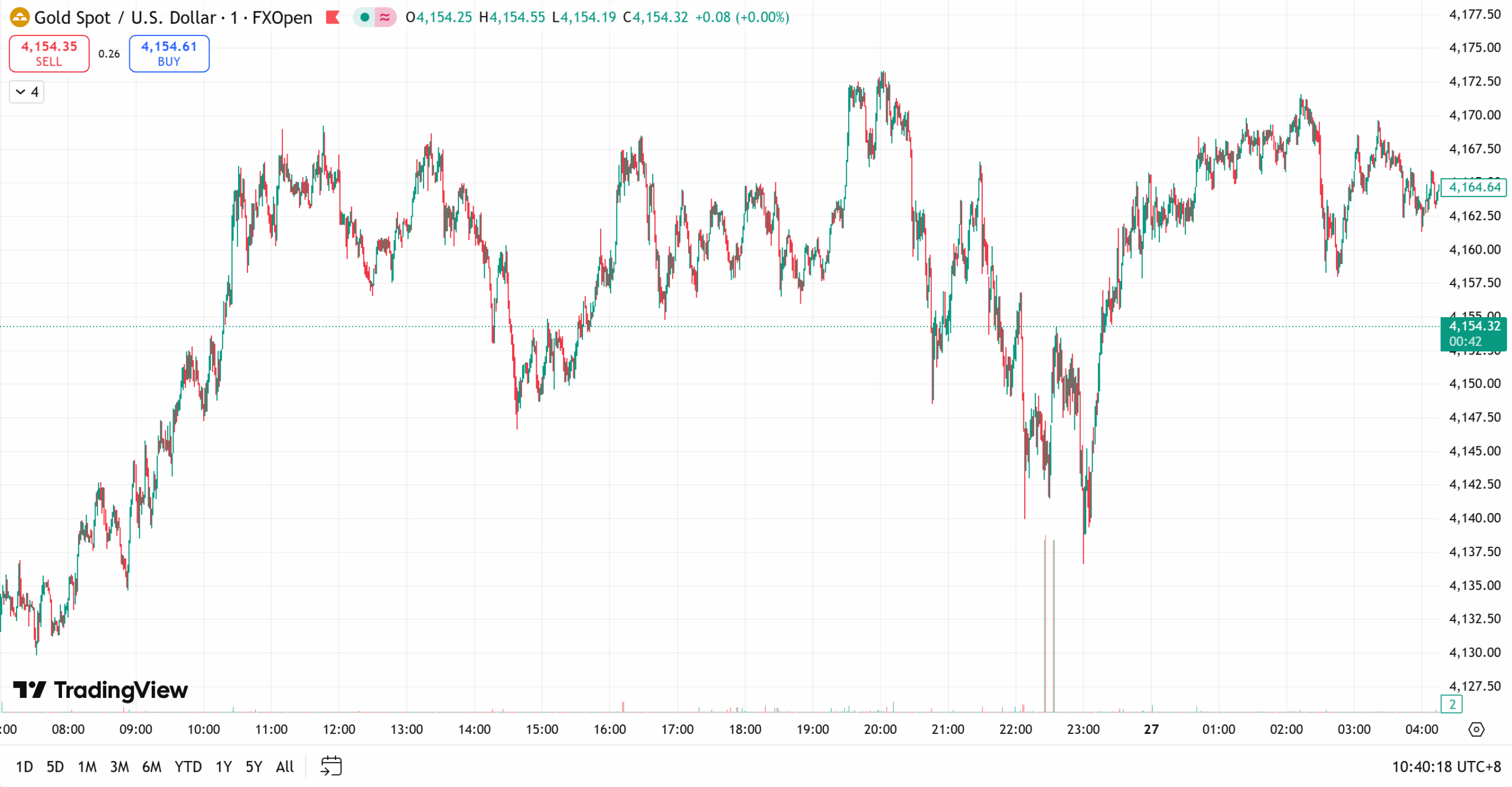

Gold

Gold extended its gains on Wednesday, climbing to over a one-week high on stronger expectations that the Federal Reserve will cut rates in December.

Spot gold rose 0.8 percent to 4162.99 dollars per ounce after hitting its highest level since November 14.

US gold futures for December delivery settled at 4165.20 dollars, up 0.6 percent.

Rate-cut expectations remain the primary driver.

According to CME FedWatch, markets now price in an 85 percent chance of a December rate cut, sharply higher than around 30 percent one week ago.

Analysts noted that even with the US dollar holding steady, “the market’s focus has shifted from the dollar to December’s rate decision,” helping gold maintain momentum.

Deutsche Bank raised its 2026 gold price outlook from 4000 to 4450 dollars per ounce, citing stable investor flows and strong central-bank buying. Most major institutions now expect gold to remain above 4000 dollars per ounce in 2026.

Gold Technical outlook:

Based on the one-hour chart, gold is expected to continue trading within a high-level consolidation zone.

Downside support remains at the 5- and 10-day moving averages near 4110-4100, while initial resistance sits at 4170-4180.

A push toward 4200 will require both technical strength and renewed fundamental catalysts.

However, holiday-related volatility later in the week adds uncertainty.

Today’s Gold Focus:

Trading is expected to favor buying dips, with short-term selling on rebounds.

- Upside resistance: 4165-4180

- Downside support: 4120-4100

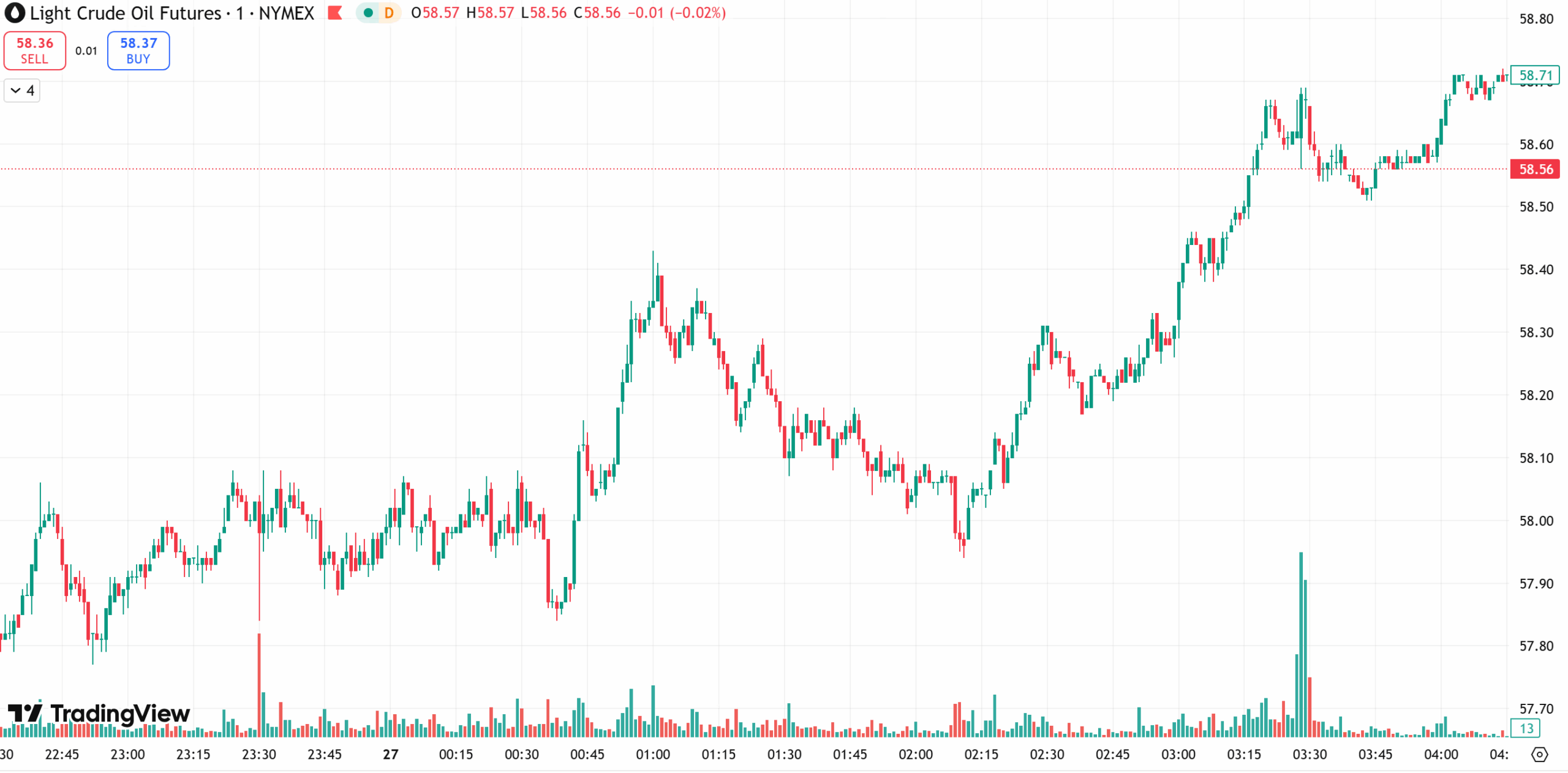

Crude Oil

Oil prices edged higher from a one-month low on Wednesday as investors evaluated oversupply risks while tracking progress in Russia-Ukraine peace negotiations.

Brent crude futures rose 1.04 percent to 63.13 dollars per barrel; WTI gained 1.21 percent to 58.65 dollars.

US EIA data showed US crude inventories unexpectedly surged by 2.8 million barrels last week to 426.9 million barrels, far above the expected 55,000-barrel increase.

John Kilduff of Again Capital commented: “We are heading toward a fairly healthy oversupply, that’s undeniable.”

However, rising expectations for a December Fed rate cut helped limit further declines.

Baker Hughes reported that US active oil rigs fell by 12 to 407, the lowest since September 2021.

Three OPEC+ sources said the group may keep output unchanged at its Sunday meeting.

Investors continue to watch Russia-Ukraine developments.

US President Trump has instructed his envoys to meet separately with Russian President Putin and Ukrainian officials.

Ukrainian officials noted President Zelensky may travel to the US in the coming days to finalize terms of a deal.

Technical outlook:

On the daily chart, crude remains in a secondary downtrend, with three consecutive bearish candles testing the 56-dollar support region.

MACD is forming a bearish crossover below the zero line, signaling building downside momentum.

On the 1H chart, oil is retesting the 57.00 area, repeatedly crossing major moving averages and entering a choppy, range-bound structure.

Momentum remains mixed, suggesting range trading is likely.

Today’s Focus:

Trading is expected to prioritize selling on rebounds, with buying near key support.

- Upside resistance: 59.5-60.5

- Downside support: 57.0-56.0

Risk Disclosure

Trading Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.