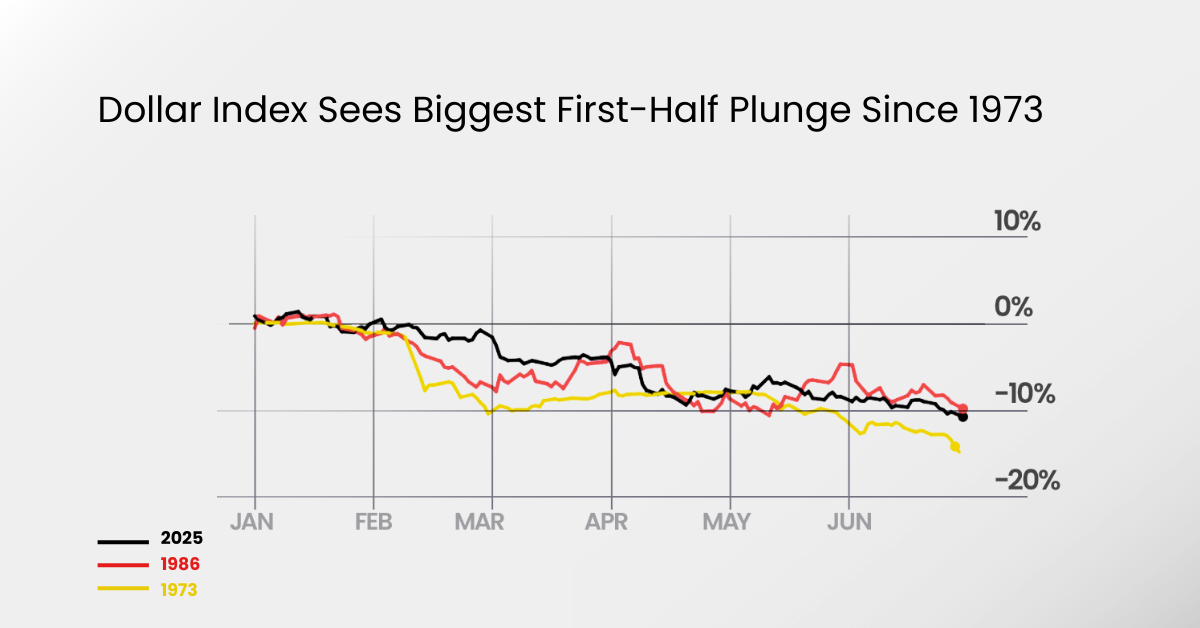

The US dollar’s performance in 2025 has taken many by surprise. The US Dollar Index (DXY) posted its largest first-half drop since 1973, tumbling sharply before a short-lived rebound in July. While that bounce recaptured some lost ground, Morgan Stanley’s research team expects the decline may not be over projecting the dollar could lose another 10% by the end of 2026.

So, what’s behind the dollar’s slide in 2025? And under what scenarios could it stage a comeback? Let’s dive in.

Dollar Performance Recap – First Half of 2025

In the first six months of 2025, the DXY fell about 10.8%, marking its worst half-year performance since a 14.8% drop in early 1973.

Analysts point to two key pressures:

- Uncertainty over Trump’s trade and tariff policies

- Rising market expectations for Federal Reserve rate cuts

Both factors have weighed heavily on the greenback.

Why the Dollar Weakened in 2025

1. Tariffs & Policy Uncertainty Undermining Dollar Support

Trump’s shifting stance on tariffs and tax reforms is creating long-term headwinds for the dollar. Protectionist measures not only strain global trade relations but also erode US export competitiveness.

The lack of consistency in policy rollouts fuels investor unease, reducing global demand for dollar-denominated assets and reinforcing the currency’s downtrend.

2. Slowing US Economic Growth

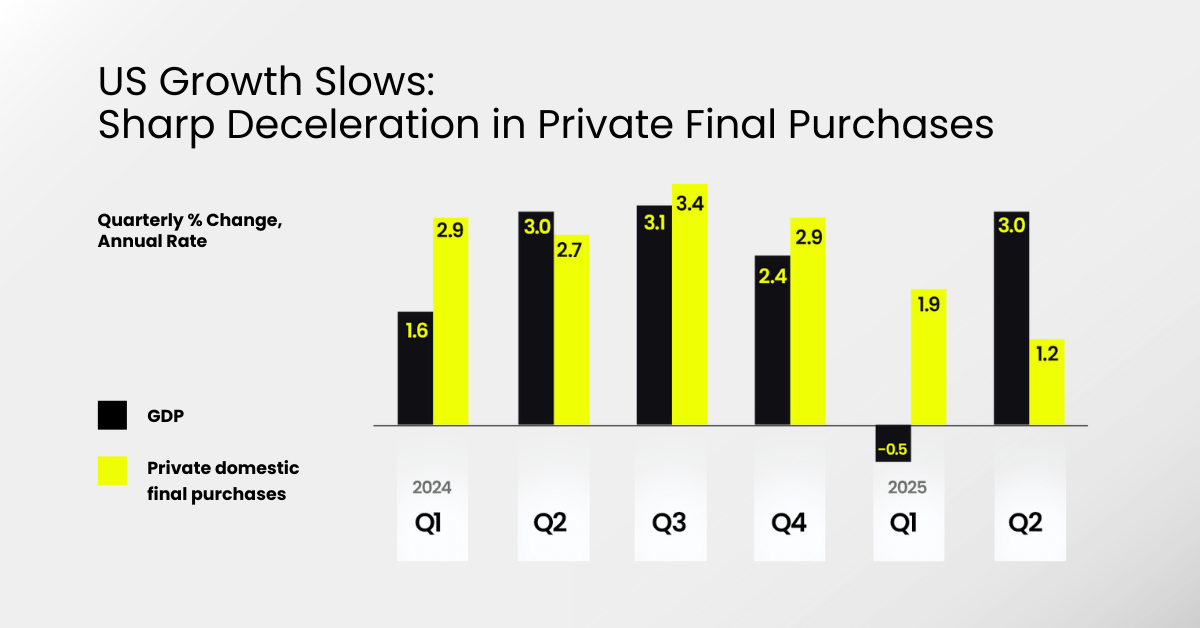

Weakening growth has further pressured the dollar, as investors redirect capital toward economies with stronger momentum.

While Q2 GDP growth of 3.0% looked solid at first glance, Morgan Stanley’s Chief US Economist Michael Gapen highlights a more telling figure:

- Private final purchases growth dropped from 2.7% last year to just 1.2%, signaling cooling domestic demand.

3. Fed Policy Uncertainty Shakes Market Confidence

Interest rates are one of the strongest drivers of currency value, yet in 2025 the Fed’s policy direction has remained unclear. Ongoing friction between Trump and Fed Chair Jerome Powell has only deepened the uncertainty.

July CPI came in below expectations, pushing the market’s forecast for a September rate cut from 85% to 91%, with rising odds for additional cuts in October and December. Lower rate expectations typically weigh on the dollar.

4. De-Dollarization Trend Gains Momentum

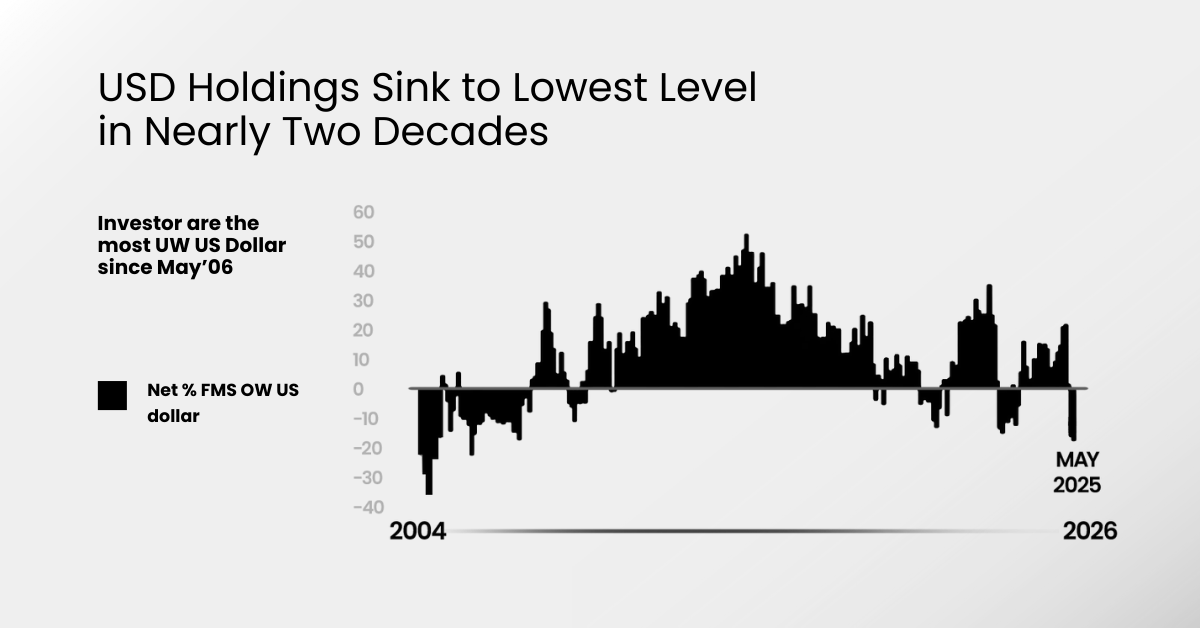

The dollar’s role as the world’s top reserve and safe-haven currency is being challenged. According to a recent Bank of America survey, global fund managers have reduced their dollar allocations to the lowest level since May 2006, underscoring waning appetite for US assets.

What Could Trigger a Dollar Rebound in 2025?

Despite current weakness, the dollar isn’t without rebound potential. Conditions that could turn sentiment include:

- Surprisingly Strong Inflation Data: Higher-than-expected CPI or PCE readings could shift expectations toward tighter Fed policy.

- Fed Signals Slower Rate Cuts: A more hawkish stance could lift dollar yields and attract capital inflows.

- Renewed Risk-Off Sentiment: Geopolitical shocks or global market stress could revive demand for the dollar as a safe haven.

Two upcoming events may prove pivotal:

- August CPI Release: A stronger-than-expected print could quickly reshape market expectations for Fed policy.

- September Fed Meeting Minutes: If the tone is hawkish, it could set the stage for a dollar rebound.

Investment Strategy in a Weak-Dollar Environment

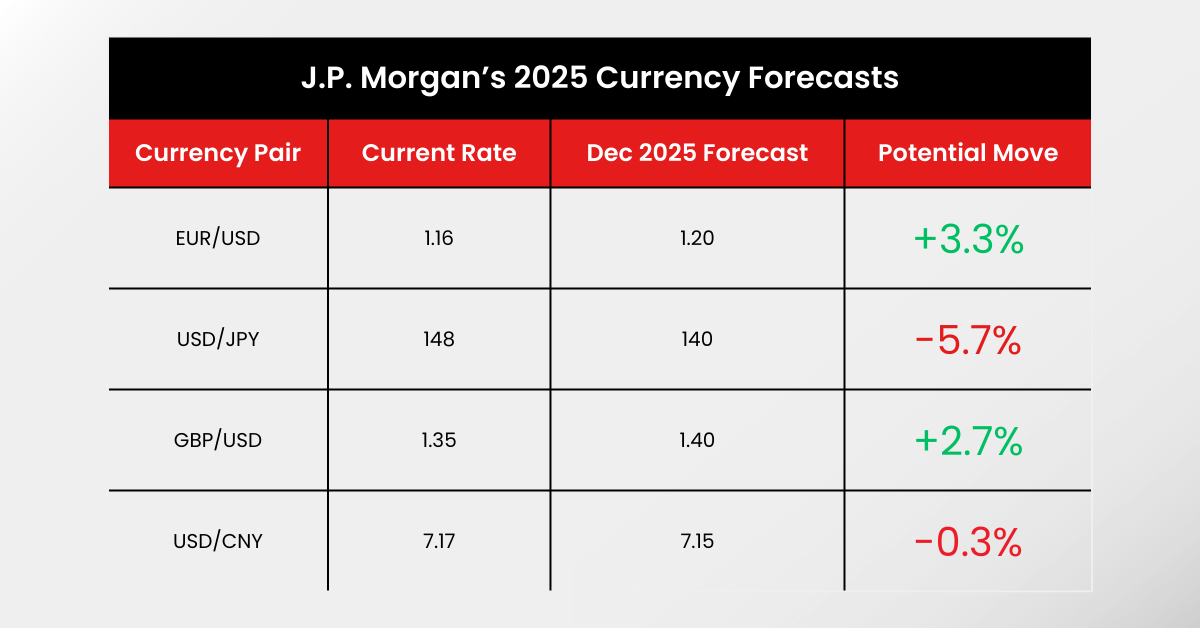

Analysts generally expect the dollar’s softness to persist into late 2025, though fading tariff uncertainty could provide pockets of support in the months ahead.

For investors, a weaker dollar is a timely reminder of the importance of diversification—balancing assets across currencies and regions can help reduce risk while capturing long-term growth opportunities.

Bottom Line: The US dollar’s trajectory in 2025 will be shaped by a complex mix of policy shifts, economic data, and market sentiment. Staying informed and agile will be key for investors navigating currency-driven market swings.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.