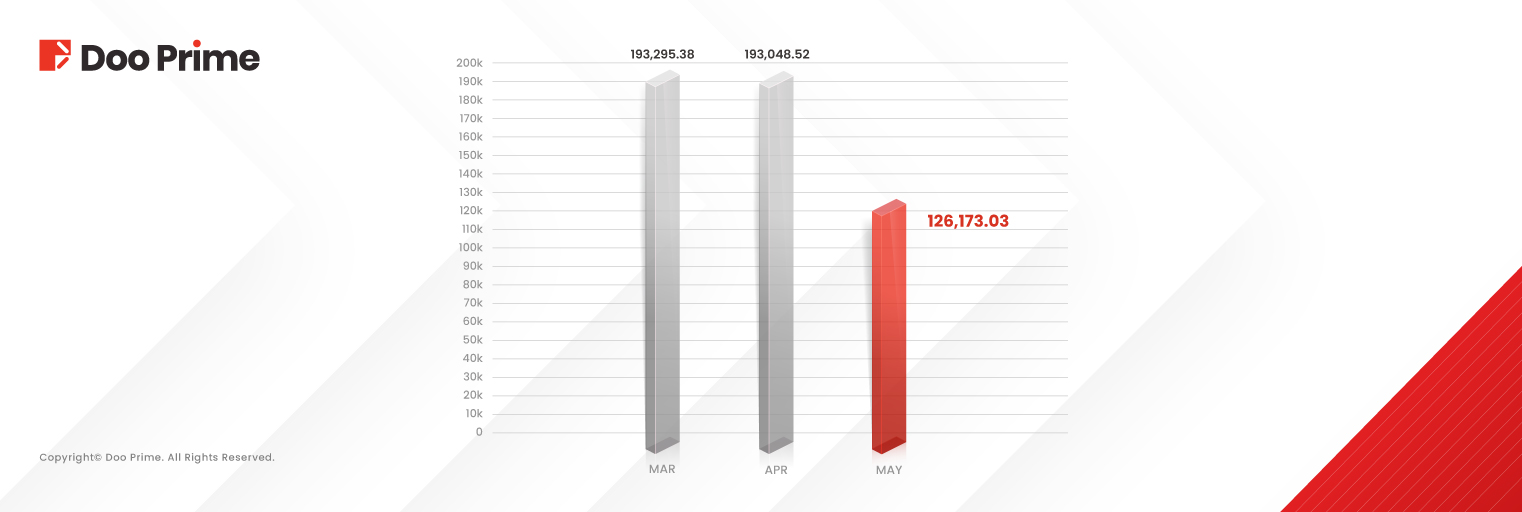

May presented a different market climate compared to the bullish tone of April, yet Doo Prime’s performance remained resilient, with trading volume reaching USD 126.17 billion. While this reflects a 34.64% decrease from April, it is important to note a year-on-year growth of 18.44%, underscoring continued investor trust and platform strength in a shifting market.

May 2025 Trading Highlights

- Total Trading Volume: USD 126.17 billion

- Average Daily Volume (ADV): USD 4.07 billion

- Top Traded Products: XAU/USD, EUR/USD, NAS100 (Nasdaq), US30 (Dow Jones), GBP/USD

- Biggest Gainer (Volume): HG_2509 (Copper Futures) – up USD 19.00 million

- Biggest Gainer (Percentage): SI_2507 (Silver Futures) – up 593.04%

Market Sentiment: A Shift Toward Caution

May’s trading activity was heavily influenced by renewed tensions in global trade policy, notably the latest announcements from President Donald Trump. The now widely referenced “TACO trade” (Trump Always Chickens Out) emerged as a trend, where investors buy into dips triggered by tariff announcements, speculating on subsequent reversals.

In this uncertain environment, investor sentiment leaned cautious. Gold (XAU/USD) remained a core asset but saw wider price swings, reflecting hesitance. In contrast, copper and silver products saw a sharp rise in interest and trading volume, signaling a shift toward industrial metals as investors diversified their portfolios.

Investor Favorites Remain Steady

Despite the overall decline in monthly volume, the most popular products remained consistent with April. The top five were:

- XAU/USD

- EUR/USD

- NAS100 (Nasdaq)

- US30 (Dow Jones)

- GBP/USD

This consistency shows investors’ ongoing preference for a blend of safe-haven assets and major indices amid market volatility.

Spotlight on Rising Products: Copper & Silver Surge

In May, a more diverse trend in product growth emerged:

- HG_2509 (Copper Futures): Recorded the largest increase in trading volume, with a surge of USD 19.00 million.

- SI_2507 (Silver Futures): Registered the highest percentage growth, skyrocketing 593.04% from April.

These figures reflect a rising appetite for alternative trading opportunities as global economic pressures reshape investor behavior.

Looking Ahead: Steadfast in Unpredictable Times

Even as market volatility reshapes trading patterns, Doo Prime remains committed to supporting our clients with professional, stable, and agile services. The year-on-year growth achieved in May reinforces our adaptability and consistent performance, regardless of broader market challenges.

Backed by robust infrastructure, global partnerships, and a highly skilled technical team, Doo Prime will continue to empower traders worldwide, helping them seize opportunities with confidence.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.