Good Morning. Markets have reacted to stories from China suggesting a steep spike in the number of cases reported and the impact on the Chinese economy could be rising. This is not going to help EUR or AUD; both of which sit exposed here but China’s economy impacts us all. Again, I have no idea how long this will go on but time is key. Stocks have hardly moved as it seems investors are using everything else to hedge the risk. Commodities, gold, EM currencies and some FX crosses all taking the brunt of the risk off moves. Selling of equities outside of Asia still seems speculative to me. But the USD is fast becoming the “go to” safe haven and I can see this breaking higher still. I have added short EURJPY today to the recommendation list at 119.45 with a tight stop (see below) due to the fact I am a little late into this trade but a break of 119.20 looks a significant event with not much below until 117.10ish. EUR crosses all look heavy with EURCHF breaking levels not seen since 2016; where is the SNB(?) and I still think AUD is too high here (see below). One thing we are seeing is some serious capital moving to the ESG or climate space in equities and I can see this growing very quickly.

Details 13/02/20

Stocks keep going and climate stocks may out-perform: More EUR weakness to come.

Equity investors are long and comfortable in the notion that central banks will ease at the first sign of any slowdown. But on top of this there is a clear and massive capital inflow into climate associated stocks and this could continue for some time. Look at the moves in Tesla for instance as the world wakes up to the demise of the combustion engine. None of us have any idea still where this virus issue with take us but it is generally felt that it will be transitory; the climate issue is not. The moves starting to show up in ESG’s are starting to trend strongly and we could even see a bubble form over the next 12 months or so and it is one that may be worth taking part in. Regulators are going to make sure this happens too. Asset managers are getting clear instructions from the likes of the EU and other jurisdictions. This note from KPMG: It is clear that investor demands coupled with regulatory imperatives mean that consideration of ESG factors is now a must for all asset managers and investment funds. On a broad macro basis, get long and stay long and there are some interesting ETFs now.

Investors are also unafraid of talk that monetary policies may not be used to boost some economies now but they believe QE will make a comeback and balance sheet expansion will be the favoured tool; adding to already loose financial conditions.

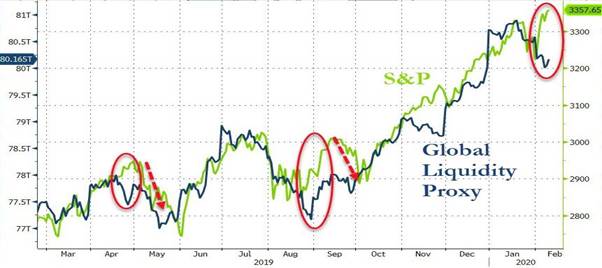

Liquidity is the oil that keeps stocks rising and there is already plenty about. If there are concerns out there about the dizzy heights of many equities then maybe look at relative value trades and again, on a macro basis, the climate stocks look favourite to me, even more so than FAANGs. Sustainable investing is here and here to stay and it is still relatively early days. Environmental stability is about to become the core of investment portfolio’s and we need to own them. Larry Fink of Blackrock said; “The evidence on climate risk is compelling investors to reassess core assumptions of modern finance. He continues “in the near future, and sooner than most anticipate, there will be a significant reallocation of capital.” This investment is already quite hot but I think the amount of capital that will be thrown at this is vast and to my mind, green investing may be in its infancy still.

Some risk assets seem to be challenging the recent rise in stocks and one in particular is EURCHF, which is breaking below recent lows set at 1.0640 back in 2016! Not by far but it is interesting that this is taking place as global stocks rise and, in some cases, make new all-time highs. It will be interesting to see if the SNB keep the bid under this cross but it is perplexing as to why it is falling. Investors who do not want to sell their stocks seem to be hedging in a few risk sensitive assets.

EM currencies are also responding far more aggressively to the virus story than developed world currencies and JPY crosses, which have hardly moved with USDJPY taking back 110.00 yesterday. Commodities also took a nasty ride lower on the story which, to date, has not been resolved. But equities have a friend in the central banks giving of liquidity; it seems nothing can trump that right now. I am not suggesting stocks can’t fall but asset managers do not see cash with rates down here as an option. They may rotate or look for relative value and to me that value is in green stocks if you HAVE to be invested.

The USD is on recent highs and looking like it may break higher, especially as the EUR is breaking down and looks likely to extend losses to me. It is slow and vols are still low in FX but we are looking more like a break forming in the USD and this is a 2.5yr low for EUR. Low vols suggest taking profits but I would keep some skin in the game as vols have been near record lows for a long time now. I think the market is still long EUR on the back of the reflation dream but EU data has been pretty dreadful and we have political uncertainty in Germany and a few others in the zone.

EUR has the next level of support at 1.0813 but I think we see it lower as the USD attracts with better data and higher yields. What we still do not know is what damage has been done to the Chinese economy and how long the disruption in the supply chains will last. But again, capital will likely move from EM to US and the EU, like Oz, are fully exposed to this. China has a problem as they need to get the economy back to work and that means taking huge risks with lives. I have said all along, it is a timing issue and if this drags on and continues to hit the Chinese economy then we may have a game changer. If China doesn’t “open for business” with unrestricted travel soon, its economy will suffer calamitous declines as fragile mountains of debt and leverage collapse and supply chain disruptions push global corporations to find permanent alternatives elsewhere. That is bad for China, the EU and Oz if not for all of us.

China has reported a new surge in cases overnight and it seems they may be allowing more of the truth to come out but the numbers are quite frightening. So far, this is still contained in China but the impact on the economy will impact us all and the USD is the “go to” safe haven now (along with CHF it seems). I still feel both EUR and AUD are exposed to this still and both should fall further against the USD, CHF and JPY. EURGBP is breaking back below .8400 as a broad negative sentiment engulfs the EUR and squeezes longs who were hoping for the EU to catch up to the US; that ain’t happening yet. The way I look at this cross is that if we break the recent low at 0.8386, it will bring a retest of 0.8276 low.

EURJPY on the charts is also precariously perched and I can see this breaking lower too.

It looks like a break of 119.20 will be seen and after that, the first test could be 117.10. I am prepared to get short here at 119.45, even though the fall has started (hence a tight stop), as I feel this virus story still has legs (would have sold it against CHF but I have some fears over what the SNB do with EURCHF here).

I also think AUD is still too high here and I remain with the short recommendation and this small rally is a healthy one but a test of serious support at .6656 looks inevitable to me soon. On a broad macro chart, that could open a trapdoor. To my mind the RBA is talking up the economy but talk is cheap and they seem too optimistic to me. Clearly, the barrier to cutting again has risen and in some capacity the RBA see structural headwinds to their mandate, where to get anywhere near the banks 2-3% inflation target (in two year time) “we’d need to cut interest rates 3 or 4 percentage points than where we are now, so it’s just not practical at the moment”. But I think the combined issue of the fires (sentiment hit) and the China impact (trade) along with the goals of the Chinese to rebalance their economy are not fully priced in AUD or Aussie rates yet. Growth aside, it’s the labour market that is key for the RBA, which is a worry given it is a lagging indicator in many capacities. My preferred leading indicators, including ANZ job ads, or NAB capacity utilisation rates, suggests upside risk to the unemployment rate in the next two to three quarters.

—————————————————————————————————————-

Strategy:

Macro:.

Short AUD @ .6875 at .6917 (average .6896).

Short USDJPY @ 109.95.. stop above 110.35 (s/t position just in case).

Today: Short EURJPY @ 119.45. Tight stop above 120.20.

Macro Long FTSE250 20,900

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.