Good Morning… A decent risk on move in Asia after Wall St pushed higher but with an interesting lag again in the tech sector. Nikkei up nearly 2%, Shanghai up 0.3%, HK up 2.5% and Kospi up 1.55%. AUD hit a high of .7185 as stocks rallied but the USD was basically restricted to a tight range at a time when it should have moved lower. The momentum of the USD down move seems to have stalled for now. Better like-for-like sales from the UK overnight but interestingly most of the spending on stay at home goods. Unemployment was also better and still Cable couldn’t rally. I think the USD shorts may have a bit more pain to endure. The only position I have is long EURGBP now and that looks vulnerable. The tech picture we saw develop at the end of last week that I mentioned yesterday, has been a good signal for USD strength this week. The issue now is if we get the US fiscal deal done and if the data is real or a head-fake from the reaction to unlocking economies. But stocks still focus solely on the snippets of good news and ignore the risks. German ZEW this morning and US PPI later. I have no new recommendations as we see USD consolidation continue and being square the USD seems the right position to me right now. .

Keep the Faith.

Details 11/08/20

Good news is now bad news for the big 5 mega-cap stocks. Looking at the macro impact from central bank policies.

–

Yesterday was an interesting one, once US equity markets opened as we saw some interesting divergent moves in certain sectors. Yesterday’s early price-action in the major US equity indices was unusual to say the least when we have been used to tech stocks leading global markets higher. A huge sudden spike in Small Caps was met with a wave of selling in Mega-Cap Tech (Nasdaq) and that raises a lot of questions. It seems to come on the back of better US data from the US last week, culminating in the NFPs beat on Friday. All indices seemed to get a boost later in the session from better stats from hospitalisations in the US from the virus but it was the lagging NASDAQ that caught the eye. What we can see clearly here (since the data), is that the recent run in growth/momentum relative to value has reversed dramatically in the last two days.

So, is this what we can expect if we are really seeing a reflation story building in the US and is that true? The data last week and prior has beaten expectations but I do think it is a little too early to discuss the US recovery with higher unemployment still a very real possibility but market sentiment seemed to shift yesterday and we saw some serious rotation out of the “stay at home stocks” that are FAANGS.

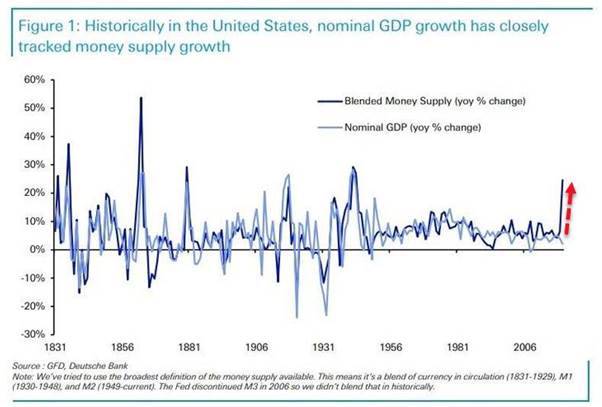

Maybe the central banks’ ability to force money supply into the system is finally spooking the deflationists into turning more inflationary and the irony is that the recovery could suggest a whole rethink of how equity investors approach US stocks. The Tech sector, long the darling of equity investors, may be on the back foot. Surely not! That would be big news but looking at yesterday’s performance. It may be the start of a great rotation.

Are we about to see the fiscal side of the equation finally kick in after all the central banks have done to force printed money into the system? If so, things are going to change rather rapidly. Monetary policy may have paved the way but it did little for the broad economy but the US fiscal stimulus has been large and is probably about to become enormous if some compromise is found. I squared up my USD positions yesterday and I will wait to see how this pans out as if stocks do stumble, the USD may start to rise and if the US is emerging from the crisis, we may see capital flowing back into the US but this time it may not be into tech. To be honest, the moves in FX were marginal yesterday and the NASDAQ ran into buying yet again on the dip through the session but it still lagged S&P and Dow. I think we now need to see if US yields start to rise or the curve steepen; that would be a real signal and I still want to see more unemployment data into year-end to suggest the US can recover quickly.

Equities in Asia rallied strongly with the Nikkei up nearly 2%, Shanghai up 0.3%, HK up 2.4% and Kospi up 1.25%. AUD hit a high of .7185 as stocks rallied but the USD was basically restricted to a tight range at a time when it should have moved lower. The momentum of the USD down move seems to have stalled for now as suggested yesterday when we looked at the technical picture. Right now the USD direction is rather clouded after a great move lower recently. Sentiment seems to be focusing on the recovery and it does seem that fiscal stimuli around the world is starting to impact. It is this and not monetary policy that is the potential cure but that may come with future side-effects as mentioned later. Yet again markets are focused solely on any scrap of good news they can find and totally ignore the worrying social unrest building across the US, US/China relations souring (China fighters fly close to Taiwan as US Health Sec. arrives), no vaccine, rising cases after unlocking and an uncertain economic outlook. The Chicago Transit Authority cut off trains and buses to the downtown area known as the Loop during the Monday morning rush hour, and the city raised all but one bridge over the Chicago River, further restricting access to the city centre due to looting in the city. The scale of social unrest in the US is getting to levels of concern.

We did not get a bailout package from the US and Trump had to sign an executive order which I guess is better than nothing. Markets basically got to see action (and crucially, so do voters and it’s the president who is taking that action). Yes, this is an election year, and so all actions need to be viewed through that lens. Of course, it is also highly controversial and, Democrats claim, of dubious constitutionality which may be challenged in court. Objectively, however, the measures don’t seem to be any more of a stretch than ones previously taken by the Democrats when in office. It does seem that the door is opening for the White House to dip into the huge Treasury balance it has on hand to keep kicking that can until 3 November. Anything to get elected! But markets need to focus on what Trump is doing to the geopolitical landscape by pushing hard on China via actions in HK and the sensitive area of Taiwan; he is playing with fire, rightly or wrongly. The arrest of Jimmy Lai and his sons in HK is a dark day for HK freedom of speech and a dark day for democracy. Will the outside world dare stand up to China over this? Also China has some distinct red lines regarding Taiwan and the US seems prepared to cross those.

What we may be seeing is the end of the unlocking boost in global economies and that data “settles down” again to reflect the true state of economies engulfed in high unemployment and a reluctance to re-engage in previous lifestyle habits. Footfall is still low and many businesses are still struggling with foreclosures and further cost cutting and job shedding is very likely. Are we seeing a real recovery here or a head fake? Take a step back and look at what is happening in the global economy, we have huge explosions, warnings of war, political polarisation, dubious constitutionality, warnings of election fraud, sanctions, tariffs, and now the arrest of press barons. I fear for the status of global trade and thus the global economy as the two biggest economies on the planet become polarised. If globalisation is dying then things are going to dramatically change very quickly. I am not sure at all that we are on a clear path back to some form of normality and I hear nothing of that sort from any central bankers either. Data from Oz and NZ last night was disappointing with Australian July NAB Biz Confidence coming in at -14 vs 1 prior, with Weekly Consumer Confidence falling to 86.5 vs 88.6 prior. In NZ, July Retail Card Spending came in at +1.1% m/m vs +6.3% prior.

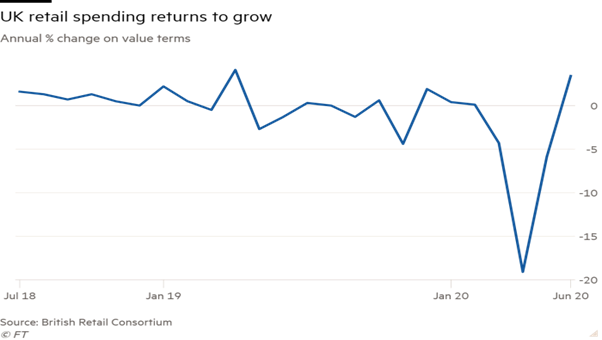

Meanwhile UK retail sales came in strongly with Sales by value increasing 3.2 per cent in July compared with the same month in 2019. This was the second consecutive month of growth following three months of falling sales, according to data published on Tuesday that was compiled by advisory services firm KPMG and the British Retail Consortium, an industry body.

Line chart of Annual change, in value terms (%) showing UK retail spending returns to grow

But what were they spending it on? Essentials by the looks of it; the biggest areas for growth were based around house improvements and homeworking. Purchases of furniture, computer equipment and home accessories increased the most of any category, year-on-year. But shoppers remained reluctant to buy luxury items, with decreases in sales reported for jewellery and watches, clothing and footwear as well as health and beauty products. But encouraging none the less but it does show how many seem to be preparing to work from home now. These data have supported GBP and EURGBP is soft again overnight. GBP has been incredibly resilient in recent days/weeks and there is some chatter building about HK capital flowing into the UK. I have no evidence of it but it may be what is keeping GBP so well supported.

Looking at the macro impact from central bank policies. The central banks need to pass the baton to the governments to push on the fiscal part of supporting the economies and to some extent that is happening but not fast or big enough to allow the central banks to take their gigantic foot off the monetary peddle. Central banks, whether they admit or not are blowing bubbles and if asset bubbles are allowed to inflate for too long, then either their eventual popping will lead to a deep depression or their continued inflation will result in a monetary crisis, with political and social disorder typically accompanying either outcome. (We may actually be seeing the start of this in the US via the social unrest we are seeing). Looking at the 2008 crisis, the signal that ought to have been conveyed was that the natural consequence for issuing fraudulent housing loans to borrowers with no income, no job, and no assets (“ninja loans”) and then securitising such loans into bundles and selling them on to clueless investors after arranging for ratings agencies to misleadingly brand them as AAA, was bankruptcy and jail-time for the institutions and individuals involved. Alas no and they kicked the can down the road to today and they are still kicking it.

It is important to remember at this point, just what the USD, or all other currencies are based upon; nothing of substance just faith in the currencies ability to be used to purchase something. Lose that faith and the USD is a worthless paper token and yet right now the very value of the USD is being systematically debased by the Fed. The end game of increasing fragility being papered over with ever greater debt and money printing, is clear to see for anyone with an unobstructed view. Is there a danger that we reach a point where the currency users or investors lose confidence in paper currencies as a store of value? Is that why gold, a true store of value, keeps rising? As the author Jim Rickards has put it, “Someday, sooner or later, confidence will be lost very quickly. Then you will have your inflation all at once.” I just wonder what real damage we are going to see from such low and negative real rates. It seems to me that on a macro basis, we are looking at a nasty feedback loop; where the crisis we faced in 2008 has not gone away, and we failed to heed its warning to change course and reduce debt levels. Instead, it has become bigger and more dangerous as, to obscure the risks we faced, we proceeded to pile up even more of the debt that had made the economy so susceptible to crisis in the first place. But that’s for later; right? The trouble is that we may be about to run smack, bang into our future. Could the unthinkable happen and investors start to stress over what current monetary policy is seeding? If they do, then things are going to change very quickly as sentiment can be a powerful tool and if there is a los of faith in our central bankers, the next step is a loss of faith in Fiat currencies!

—————————————————————————————————————-

Strategy:

Macro:.

Short USDJPY @ 105.25.. Exited trade at 105.85

Long EUR @ 1.1762 Stopped out at zero cost.

Long EURGBP @ .9030.. Stop at .8950ish.

Brought to you by Maurice Pomery, Strategic Alpha Limited.

—————————————————————————————————————-

Strategic Alpha Report Disclaimer

Doo Prime endeavor to ensure the reality, adequacy, reliability and accuracy of all the information provided, but do not guarantee its accuracy and reliability. All the information, analyses, comments, statements, and/or data provided in this report is for information purposes only. Client’s use of any contents of the report as the basis for the transaction, the client shall fully aware of the risks and agreed to bear all the risks. Client shall cautiously judge the accuracy of the information. Doo Prime has no liability for any loss caused by any inaccuracy or omissions of the contents and subjective reasons of Client.

Risk Warning

This information is powered by Strategic Alpha. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.