1. Forex Market Insight

EUR/USD

The dollar index fell 0.62% to 98.37 yesterday, weakening for the second day in a row. It briefly rose after the Fed’s policy decision was announced.

Fed Chairman Jerome Powell said in a post-meeting press conference that the U.S. economy is very strong and is well-positioned to respond to monetary policy tightening. Meanwhile, we are concerned about the risk of further upward pressure on inflation and inflation expectations.

The dollar’s rally pulled back, leading to a third straight day of gains for the euro against the dollar, up 0.73% at 1.1033.

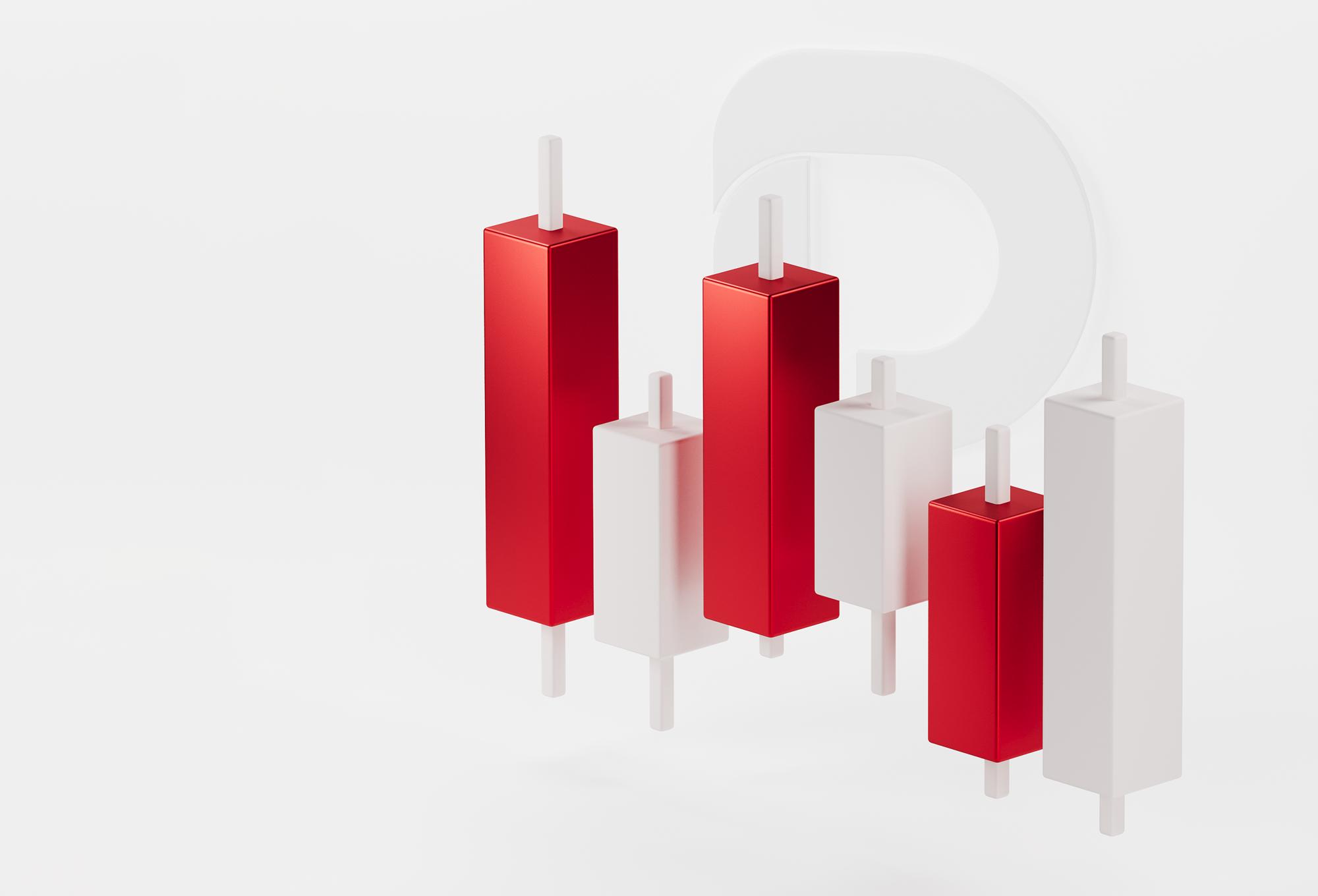

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today we focus on the 1.0940-line. If the euro runs steadily above the 1.0940-line, then pay attention to the suppression strength of the two positions of 1.1055 and 1.1096. If the strength of the euro breaks below the 1.0940-line, then pay attention to the support strength of the two positions of 1.0890 and 1.0832.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose 0.81% to 1.3145 against the dollar yesterday. At the same time, the Bank of England is set to meet on Thursday and the market expecting the central bank to raise interest rates by another 25 basis points.

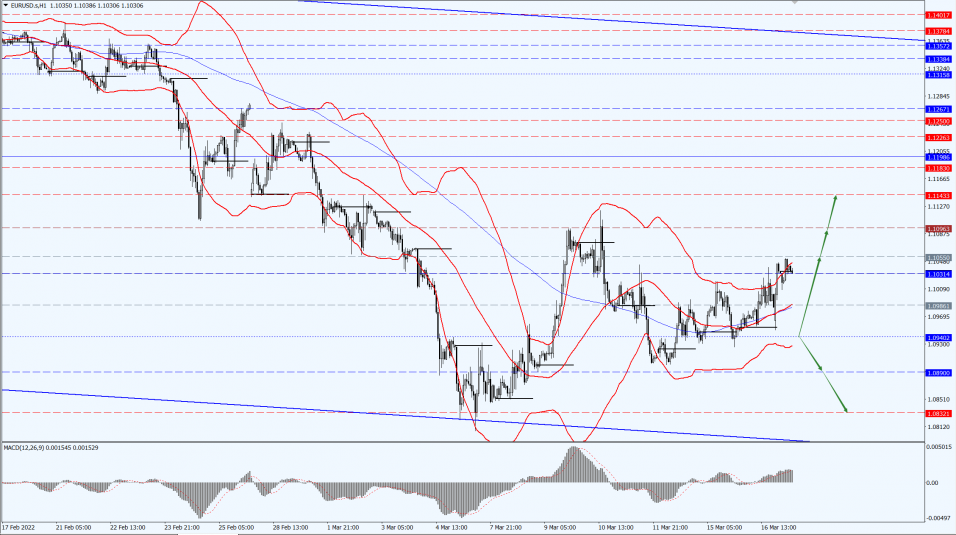

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3104-line today. If the pound runs above the 1.3104-line, it will pay attention to the suppression of the 1.3186 and 1.3276 positions. If the pound runs below the 1.3104 line, it will pay attention to the support strength of the 1.2991-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday, 16th March 2022, gold staged a reversal of selling expectations and buying facts. Spot gold eventually moved higher, and rose by more than $30 from the daily low in late trading to close at $1,926.70 per ounce.

The U.S. dollar weakened after the U.S. Federal Reserve raised interest rates by 25 basis points, as widely expected.

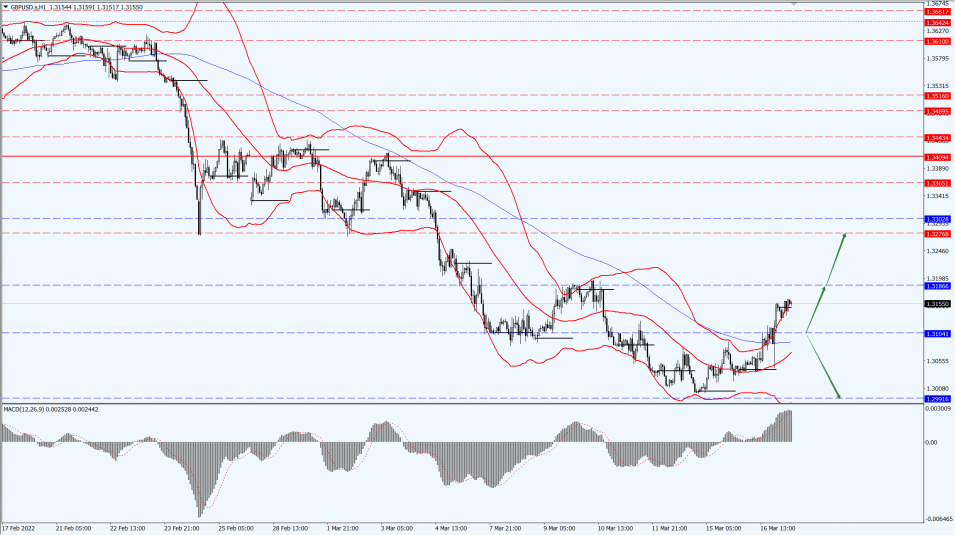

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is concerned about the 1909-line today. If the gold price runs steadily above the 1909-line, it will pay attention to the suppression of the 1948 and 1960 positions. If the gold price breaks below the 1909-line, it will open up further downside. At that time, we will pay attention to the support strength of the two positions of 1896 and 1880.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The oil market has been on a roller coaster ride for more than two weeks, with the intra-day trading range for both indicator contracts reaching their widest levels since mid-2020 over the past 30 days.

Brent rose 28% in six sessions before falling 24% in six sessions including Wednesday, 16th March 2022.

On 7th March 2022, oil prices had touched a 14-year high and then retreated. From now on, the market will be biased to focus on news about Russia-Ukraine negotiations, ceasefire or troop withdrawal.

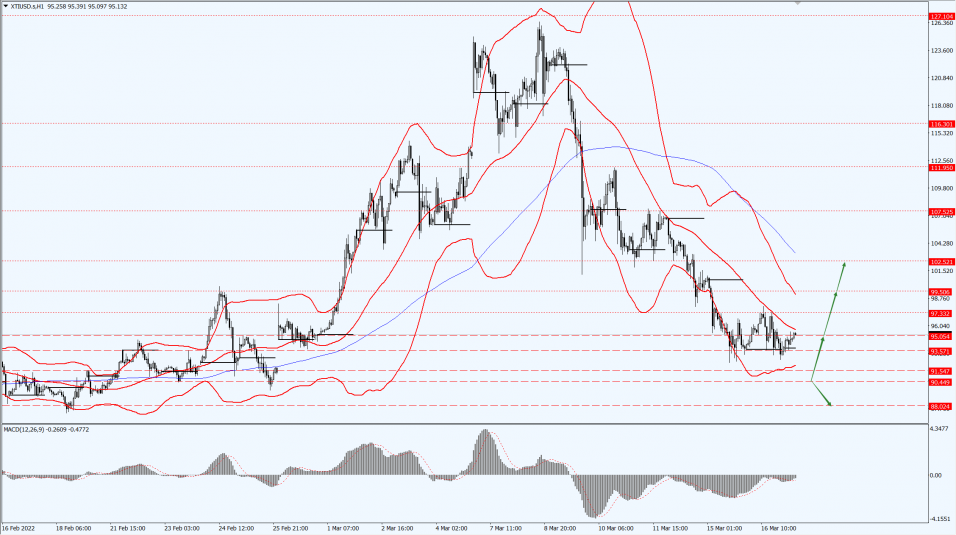

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

The oil price is focused on the 90.44-line today. If the oil price runs above the 90.44-line, then it will pay attention to the suppression strength of the 95.05 and 99.50 positions. If the oil price runs below the 90.44-line, it will pay attention to the support of the 88.02-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.