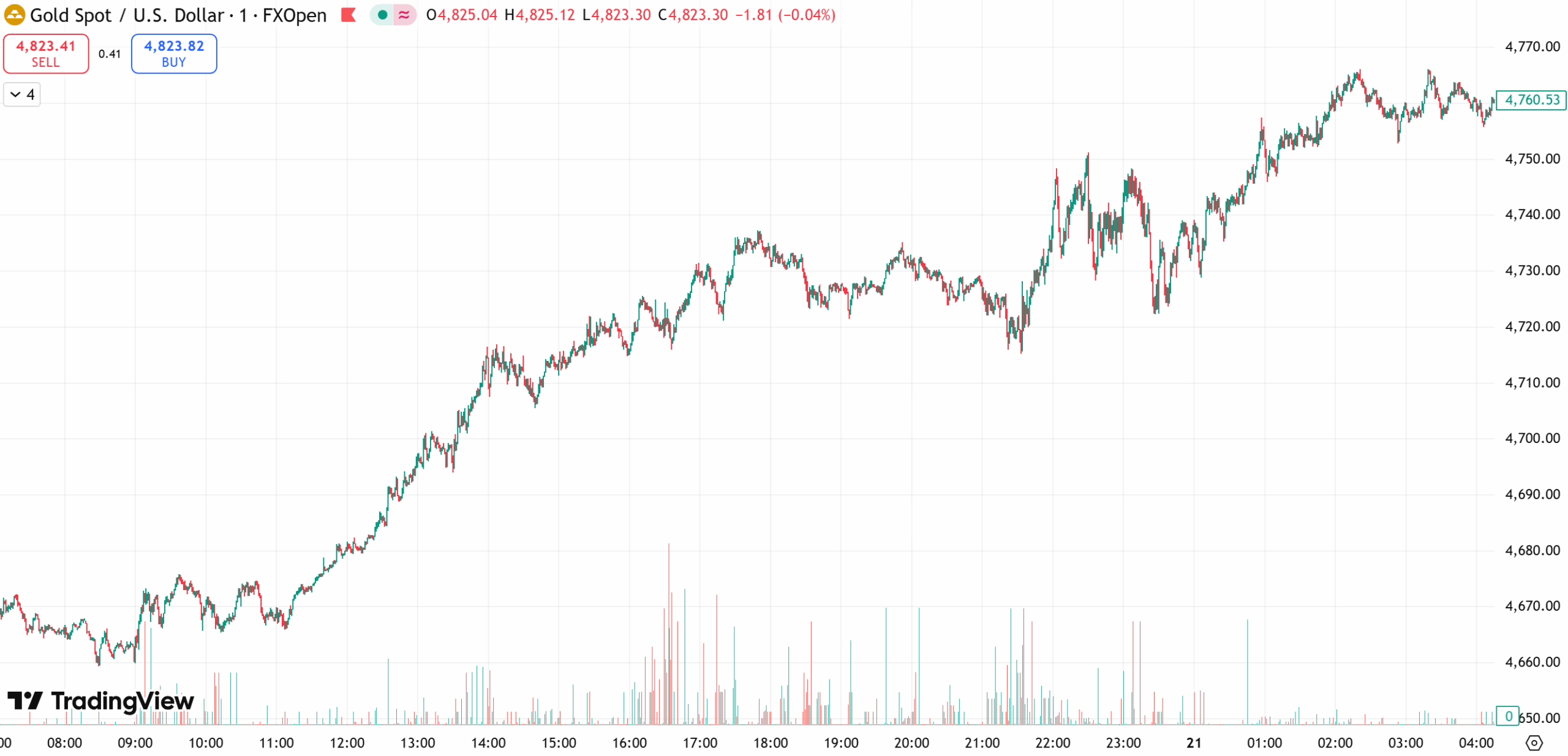

Spot gold traded near $4,760/oz in early Asian trading on Wednesday after surging to a fresh record high of $4,766.15/oz on Tuesday, with prices potentially targeting the $4,800/oz level. Safe-haven demand intensified as markets reacted to renewed tariff threats from US President Donald Trump toward multiple European countries over the Greenland issue.

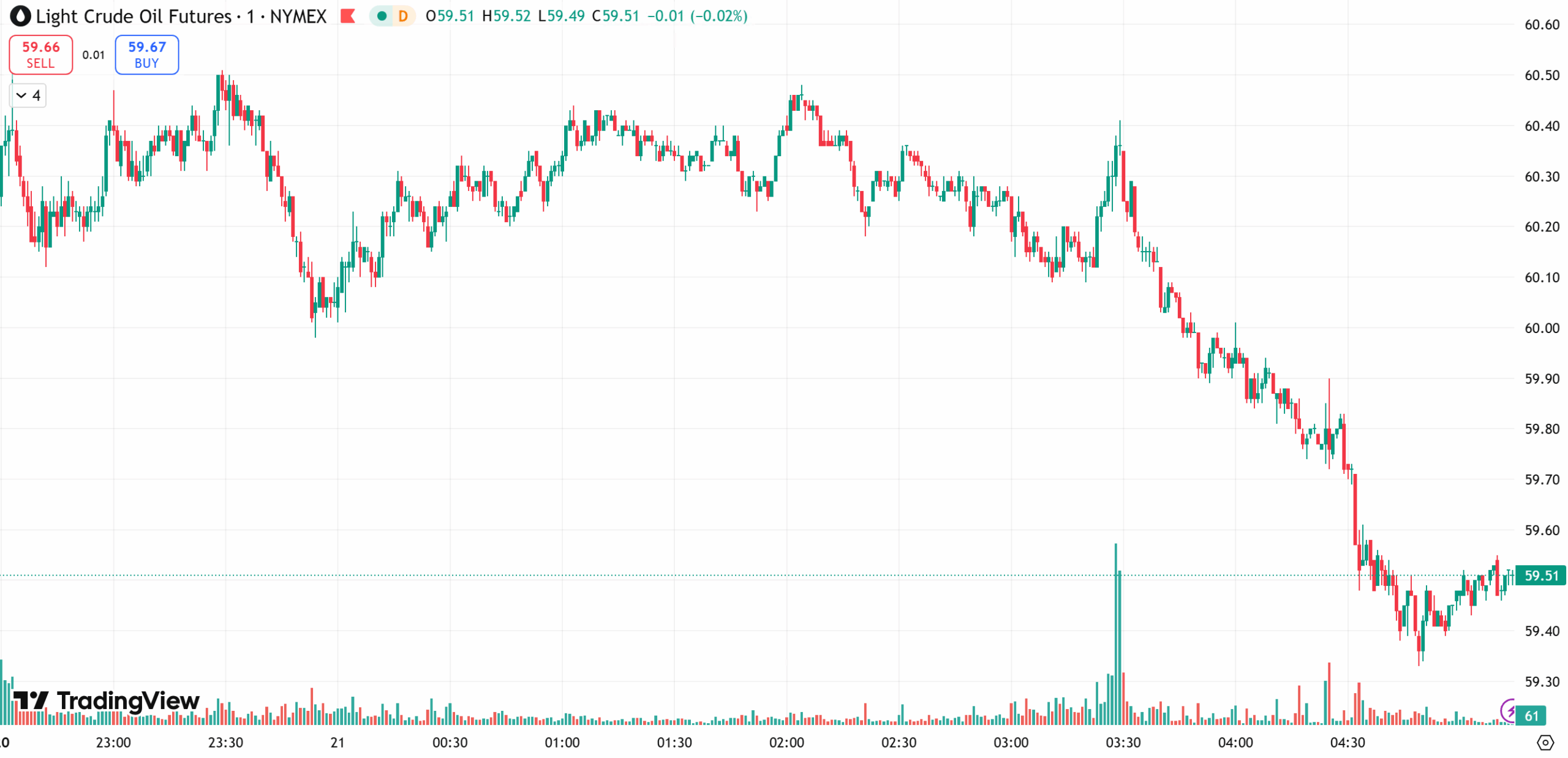

Meanwhile, WTI crude oil hovered around $59.61/barrel, supported by a temporary shutdown at a major oil field in Kazakhstan and improving global growth expectations, while investors continued to monitor rising geopolitical tensions linked to Greenland.

Gold

Gold prices surged past the $4,700/oz milestone, setting a new all-time high at $4,766.15/oz, driven by escalating geopolitical tensions. Spot silver also broke above $95/oz for the first time, underscoring the sharp rise in demand for political risk hedges.

Spot gold gained around 2% on Tuesday, hitting an intraday high of $4,766.1/oz. US February gold futures jumped 3.7% to settle at $4,765.80/oz.

Market analysts noted that Trump’s renewed threats to impose tariffs on European countries over the Greenland dispute unsettled investors, pushing major Wall Street indices to their lowest levels in nearly three weeks. This risk-off shift significantly boosted demand for safe-haven assets such as gold.

At the same time, the US dollar weakened sharply, making dollar-denominated gold more attractive to overseas buyers and providing additional upside support.

As a traditional refuge during periods of economic and political uncertainty, gold surged 64% in 2025 and is already up more than 10% year-to-date. Expectations that the Federal Reserve could begin cutting interest rates twice by mid-2026 have also reduced the opportunity cost of holding non-yielding assets, further supporting gold prices.

Technical Outlook:

Gold opened near $4,672.3/oz, briefly pulled back to $4,659.2/oz, and then surged sharply on renewed safe-haven flows, reaching an intraday high of $4,766.8/oz. Prices later consolidated and closed around $4,763.6/oz, forming a strong bullish daily candle with a long lower shadow. This price action suggests bullish momentum remains intact, with further upside potential in the near term.

Key Levels to Watch:

- Resistance: $4,790 – $4,800

- Support: $4,750 – $4,720

Oil

International oil prices finished mixed on Tuesday, although WTI briefly touched $60.50/barrel, supported by a temporary production halt at a major oil field in Kazakhstan and improving global growth expectations. Markets also remained alert to geopolitical risks surrounding Greenland.

Brent crude rose 1.53% to $64.92/barrel, while WTI March futures gained 1.72% to settle at $60.36/barrel. Production at Kazakhstan’s Tengiz and Korolev oil fields, operated by Chevron-led Tengizchevroil, was suspended due to power distribution issues. Sources indicated the outage could last 7 to 10 days, potentially affecting Caspian Pipeline Consortium exports.

Meanwhile, a major Asian economy reported 5.0% GDP growth in 2025, with oil output rising 1.5%, reinforcing optimism around global fuel demand. The weaker US dollar also lent support to dollar-denominated oil prices.

Technical Outlook:

WTI opened near $59.47/barrel, dipped to $58.80/barrel, then rallied sharply to $60.62/barrel before pulling back into the close around $59.61/barrel. The daily chart formed a shooting star pattern with a long upper shadow, suggesting upside rejection and a return to range-bound trading.

Key Levels to Watch:

- Resistance: $60.5 – $61.5

- Support: $59.0 – $58.0

Strategy Focus:

Sell on rebounds, buy cautiously on pullbacks.

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial trading or investment decisions.