Market Recap

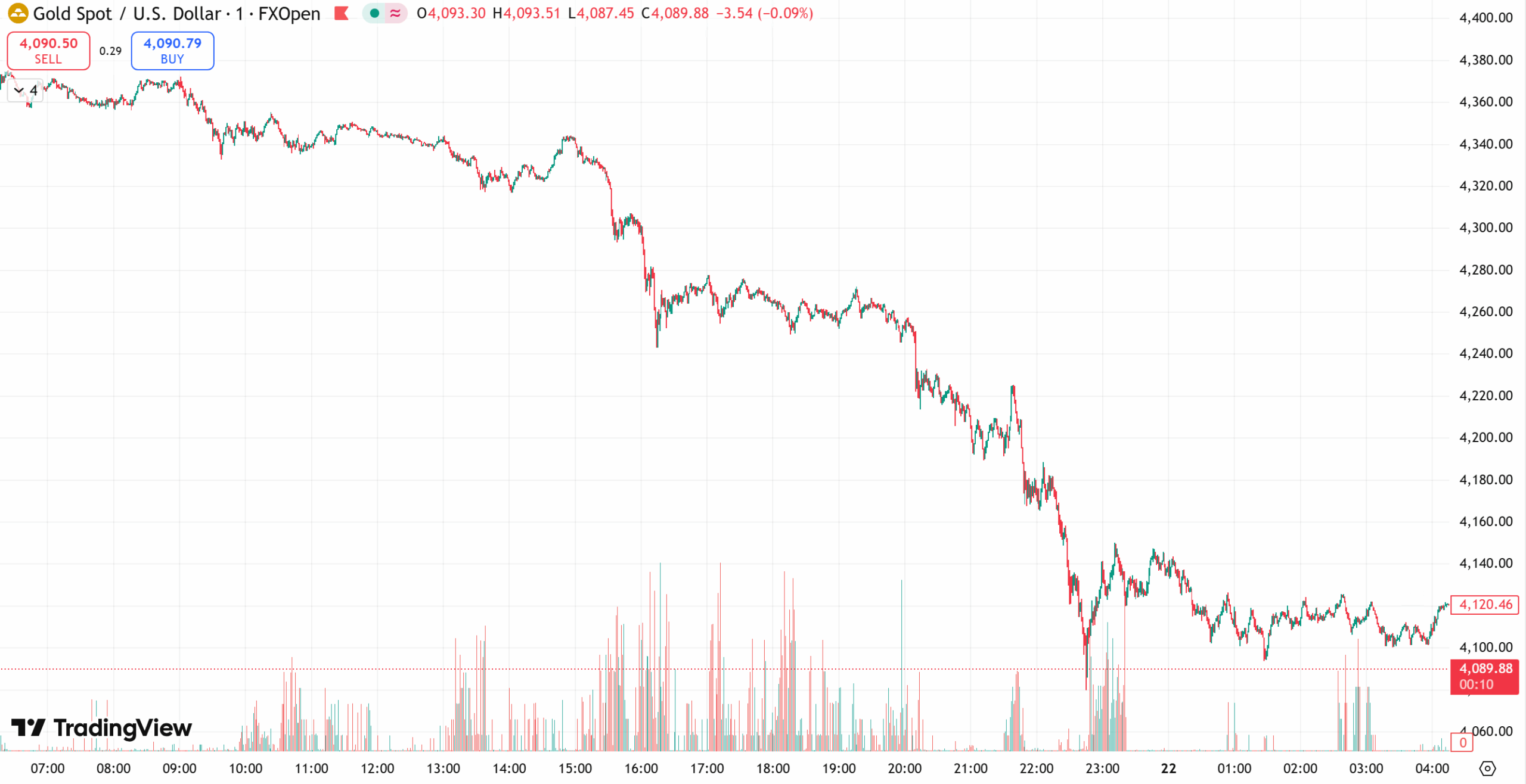

On Tuesday, spot gold traded near $4,115/oz, plunging more than 5%, its steepest one-day drop in five years, as optimism grew over a potential U.S. government reopening and trade deal progress, prompting investors to take profits after a record rally.

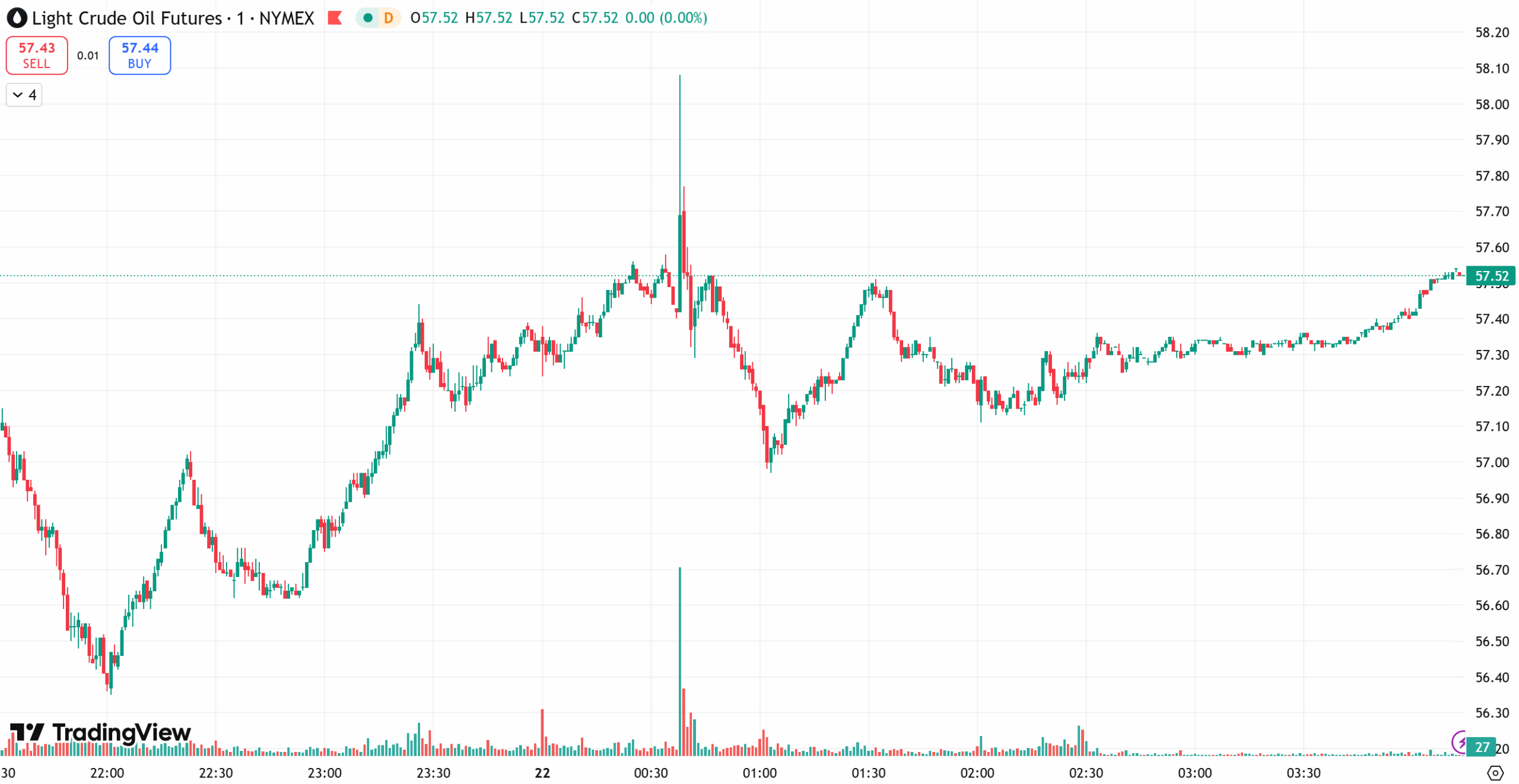

Meanwhile, U.S. crude traded around $57.58/bbl, rising as traders reassessed the risk of a supply glut and awaited clearer signals on trade negotiations.

Gold

Gold suffered its sharpest one-day decline in five years as investors took profits following a historic surge driven by rate-cut bets and safe-haven demand.

Independent metals trader Tai Wong noted that while dip-buying continues, “the surge in volatility over the past week signals caution and likely encouraged short-term profit-taking.”

Jim Wyckoff, Senior Analyst at Kitco Metals, added that an improvement in overall risk appetite early this week “weighed on safe-haven assets.”

Analysts at Citigroup said expectations that the U.S. government shutdown may soon end and a trade agreement could be reached are likely to push gold into a short-term consolidation over the next few weeks.

Gold Technical outlook:

Gold’s recent moves highlight an emotional, volatility-driven market. The metal initially consolidated near $4,270, then unexpectedly surged to $4,381/oz before reversing lower. The pattern reflects a battle between bullish momentum and waning enthusiasm, while buyers remain active, volume and follow-through have weakened.

Analysts expect gold to enter a sideways correction phase, where sharp intraday swings persist but the likelihood of another major breakdown remains low.

Today’s Gold Outlook:

- Strategy: Sell on rebounds, buy on dips

- Resistance: $4,170 – $4,190

- Support: $4,100 – $4,080

Crude Oil

Oil prices rebounded Tuesday from a five-month low, as traders reassessed concerns about oversupply and awaited direction on ongoing trade tensions.

The recent selloff came after U.S. crude production hit a record high and OPEC+ reaffirmed plans to boost output, heightening fears of an oversupplied market.

However, Bjarne Schieldrop, Chief Commodities Analyst at SEB, said that “relatively low U.S. crude and distillate inventories are helping to offset some of the downward pressure.”

While trade disputes continue to cloud the global growth outlook, both sides have reportedly signaled interest in reducing tensions, providing modest support to sentiment.

Technical outlook:

On the daily chart, oil remains in a downward trend, with MACD lines diverging below zero and bearish momentum intact. On the 1-hour chart, prices touched a new low near $56/bbl, showing early signs of bottom divergence, as lower wicks suggest buying support at the bottom of the range.

Intraday movement is expected to remain volatile within a downward bias.

Today’s Outlook:

- Strategy: Sell on rebounds, buy on dips

- Resistance: $58.0 – $59.0

- Support: $55.5 – $54.5

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.