On Tuesday, spot gold traded near 4210 dollars per ounce, firming ahead of the highly anticipated Federal Reserve interest rate decision. Silver stole the spotlight, surging 4.2 percent and breaking above 60 dollars for the first time in history. Crude oil traded near 58.40 dollars per barrel, pressured by progress in Russia–Ukraine peace talks, ample supply, and caution ahead of the Fed meeting.

Gold

Precious metals strengthened broadly on Tuesday as markets positioned for the upcoming Federal Reserve rate decision. Spot gold rose 0.5 percent to 4208.83 dollars per ounce, with traders widely expecting a rate cut.

Silver delivered the standout move, jumping 4.2 percent and breaking decisively above the 60 dollar level for the first time, closing at 60.59 dollars. Analysts attribute silver’s explosive momentum to strong industrial demand from solar, EVs, data centers, and AI, combined with ongoing supply tightness, falling inventories, and expectations of Fed easing.

Platinum and palladium also advanced, rising 3 percent and 2.7 percent respectively.

Attention now turns to the December Fed meeting. According to CME’s FedWatch tool, traders assign an 87.4 percent probability to a 25 basis point rate cut. Meanwhile, stronger-than-expected October job openings highlighted continuing labor-market resilience, increasing interest in the Fed’s guidance on future policy.

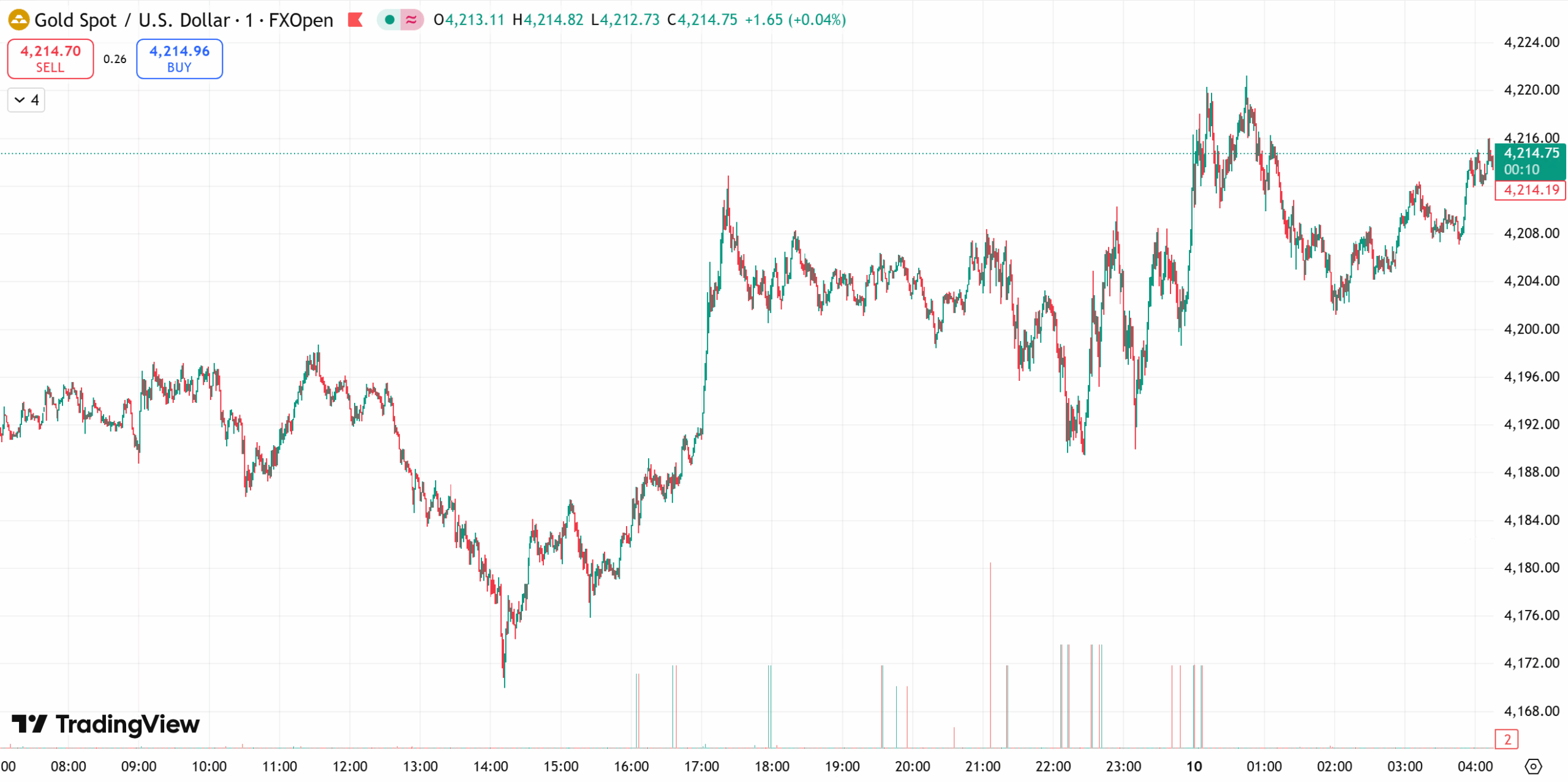

Gold Technical outlook:

Gold posted a small bearish candle on Tuesday, closing right at the 10-day moving average and failing to confirm a downside break. Intraday price action dipped toward 4170 before rebounding sharply, reflecting intense tug-of-war between bulls and bears at elevated levels. With the Fed decision and Powell’s press conference arriving at 3 AM Thursday, volatility is expected to expand significantly. Historically, gold often sells off briefly on a “buy the rumor, sell the fact” reaction after a rate cut, potentially creating a better dip-buying opportunity.

Today’s Gold Outlook

Bias: Buy dips, sell rebounds.

Resistance: 4230 – 4250

Support: 4190 – 4170

Crude Oil

Oil prices fell for a second straight session on Tuesday as markets focused on Russia–Ukraine peace talks, ample global supply, and the upcoming Fed announcement.

Brent crude slipped 0.88 percent to 61.94 dollars per barrel. WTI fell 1.07 percent to 58.25 dollars.

Markets are watching negotiations that could potentially end the Russia–Ukraine war. A breakthrough could remove sanctions and release additional Russian supply, pressuring prices. Supply concerns remain elevated following Iraq’s restart of production at a major oil field.

Although a Fed rate cut typically supports energy demand, analysts expect limited short-term benefit. With traders cautious ahead of the decision, oil is likely to remain range-bound in the near term.

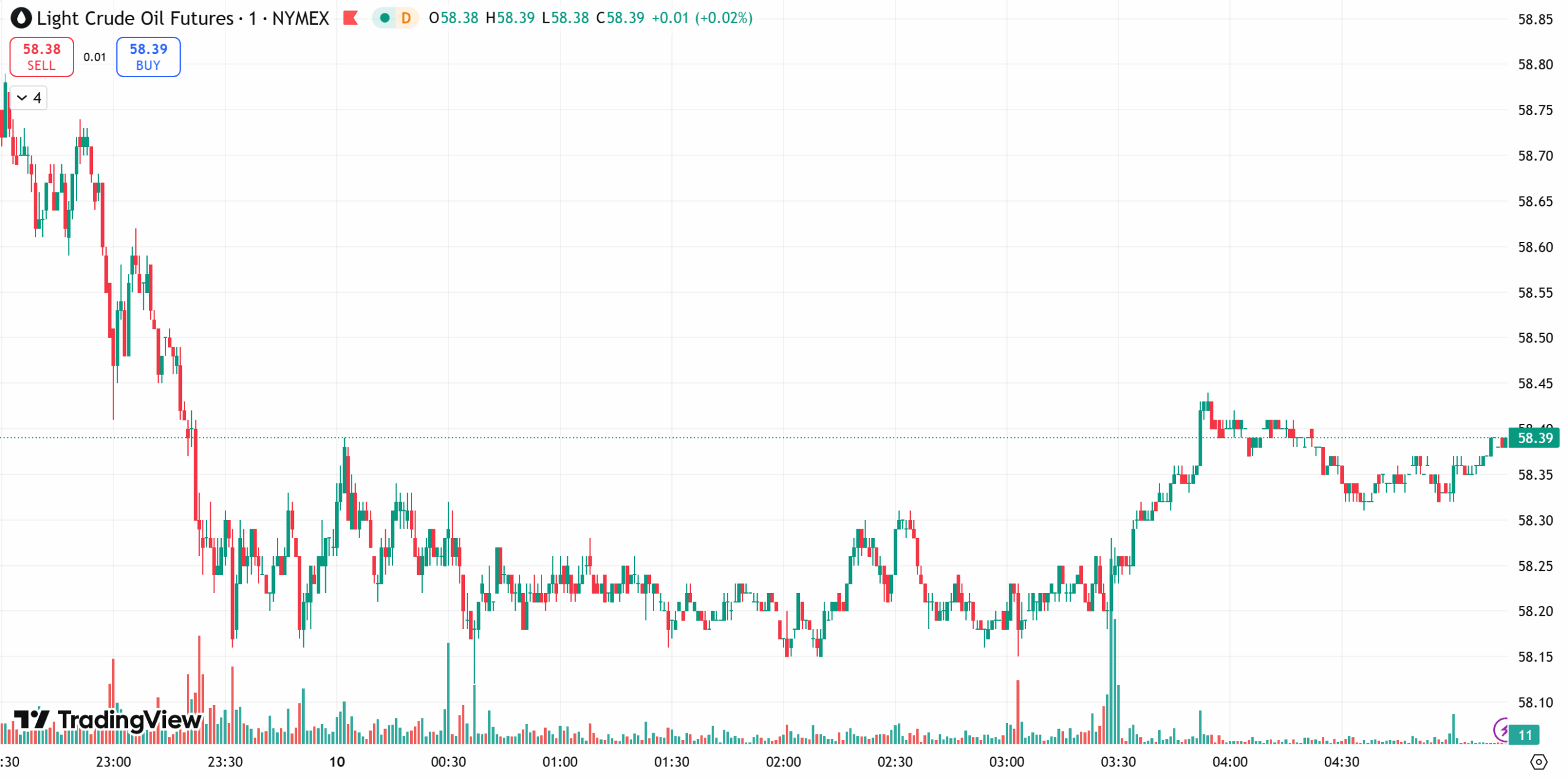

Technical outlook:

Daily price action shows ongoing secondary consolidation, with candles alternating direction and gradually retesting the 56-dollar zone. MACD remains weak near zero, reflecting soft bearish momentum. On the 1-hour chart, oil has reversed from its uptrend channel, broken below the key 60-dollar psychological level, and entered a short-term downtrend. Weak consolidation at the lows suggests further downside risk today.

Today’s Outlook

Bias: Sell rebounds, buy dips cautiously.

Resistance: 59.5 – 60.5

Support: 57.0 – 56.0

Risk Disclosure

Trading Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.