Market Recap

Gold extended its rally on Tuesday, climbing to a three-week high near $4,135/oz, as markets anticipated the end of the US government shutdown and the resumption of key economic data, which could strengthen the case for a Fed rate cut in December. Meanwhile, crude oil traded near $61/barrel, gaining on new US sanctions against Russia and optimism surrounding the potential reopening of the US government, though persistent oversupply concerns capped gains.

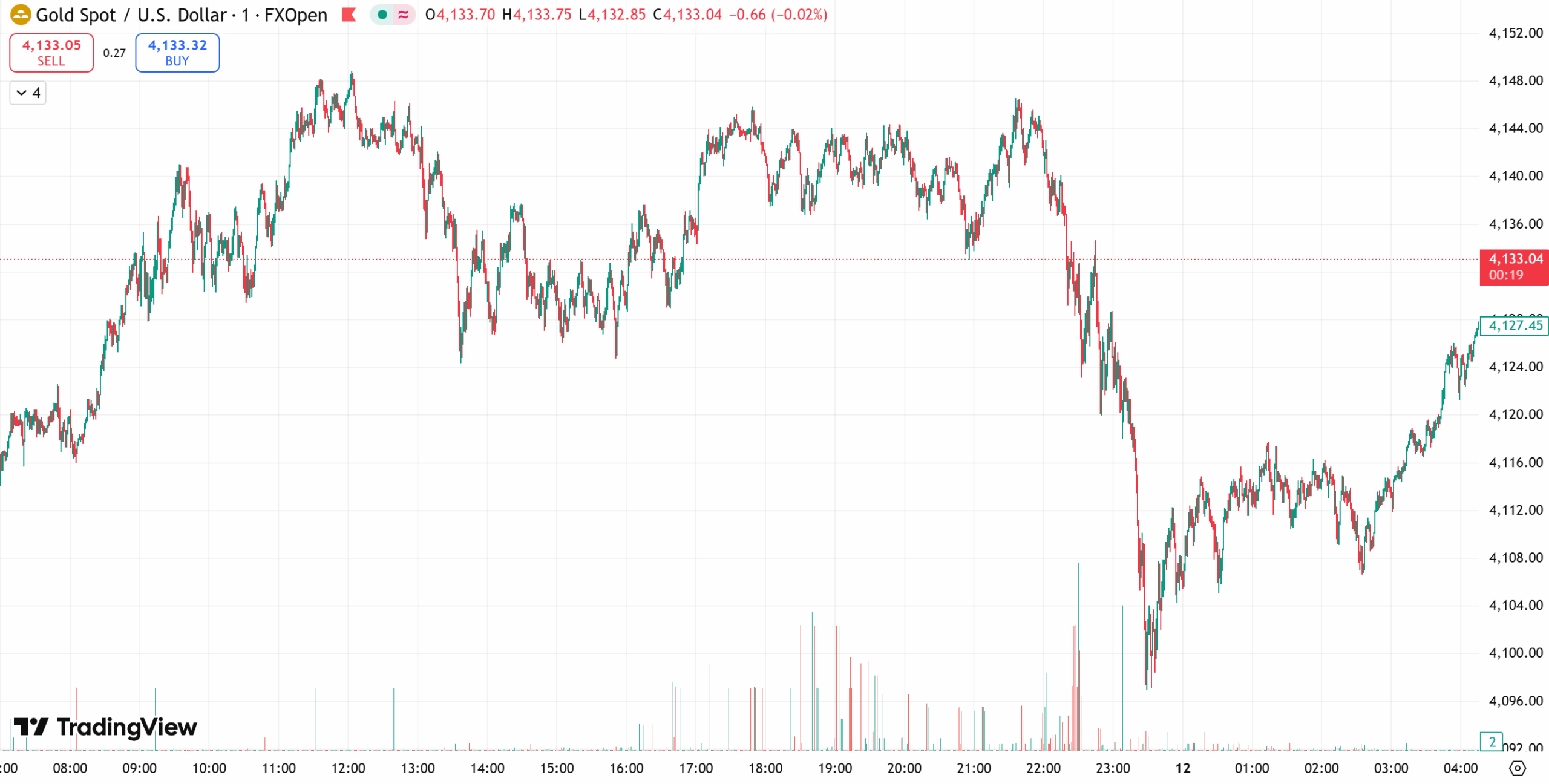

Gold

Spot gold rose 0.3% to $4,126.77/oz, its highest level in nearly three weeks. The rally was fueled by expectations that once the government reopens, the release of delayed US economic data could support a December rate cut. Traders now see a 64% probability of a Fed rate cut next month, according to market pricing.

Fed Governor Michelle Bowman added to the dovish tone, suggesting that given a weaker labor market and easing inflation, a 50-basis-point cut in December “may be appropriate.”

The Senate’s approval of a compromise funding deal marked a key step toward ending the longest US government shutdown in history. The data blackout has left both policymakers and investors struggling to assess economic conditions, heightening anticipation for the upcoming reports once data releases resume.

UBS noted that gold demand in 2024–2025 could reach its strongest level since 2011, citing both safe-haven buying and long-term structural demand as supportive factors.

Technical View:

Gold’s bullish momentum remains intact after a sharp breakout above consolidation zones. The metal formed a double bottom near $4,076 before surging to new highs. A close above $4,135 could open the door to further gains toward $4,150–$4,218.

Short-term support is seen at $4,090–$4,070, while a pullback to these levels could present new buying opportunities.

Today’s Outlook:

- Strategy: Buy on dips, sell on rebounds.

- Resistance: $4,140–$4,160

- Support: $4,090–$4,070

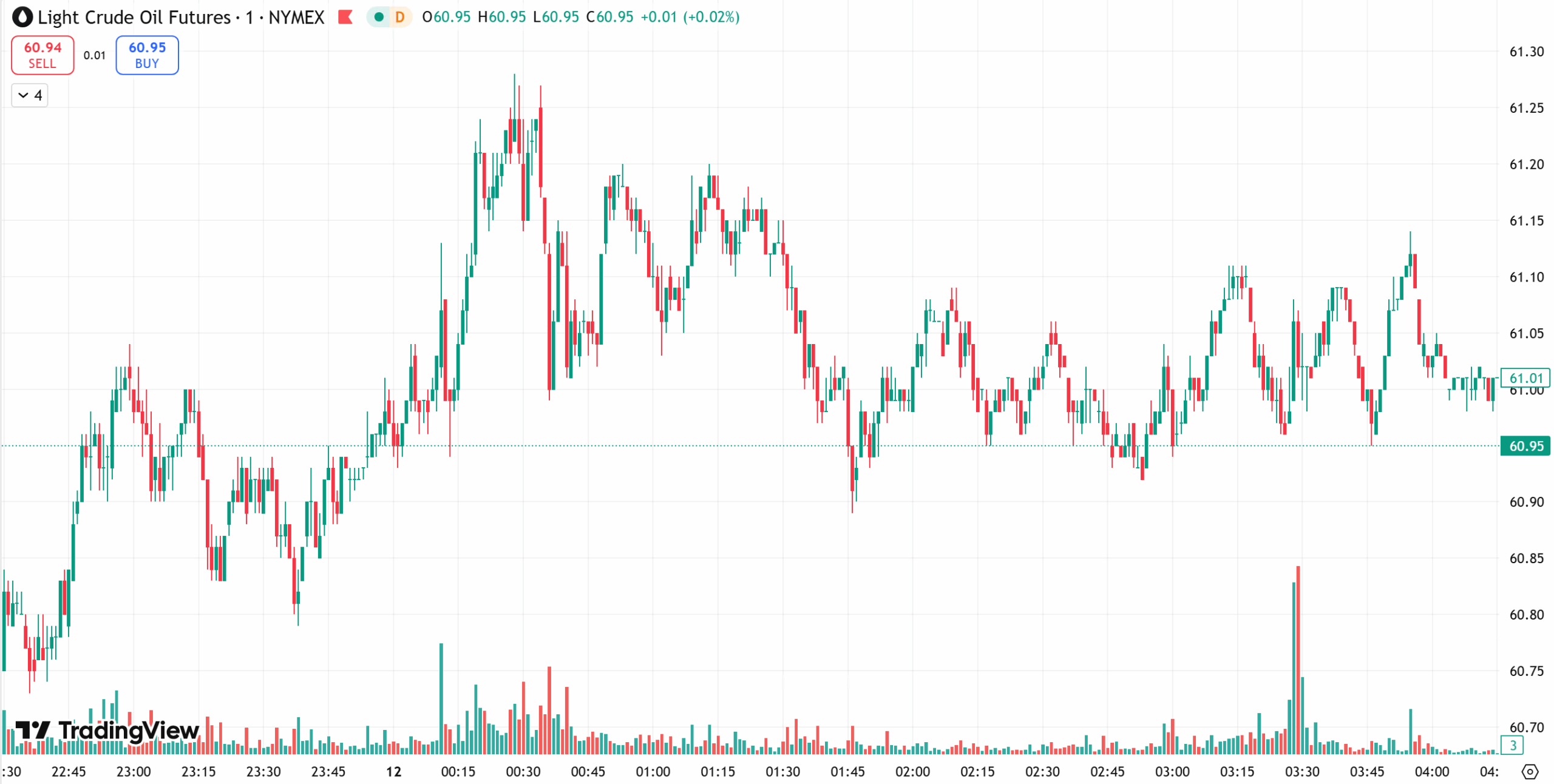

Oil

Oil prices rose sharply on Tuesday, with Brent up 1.72% to $65.16/barrel and WTI up 1.51% to $61.04/barrel, supported by fresh US sanctions on Russia and progress toward ending the US shutdown. However, concerns over global oversupply continued to limit the upside.

Reports indicated that Lukoil declared force majeure on its Iraqi operations — the first direct impact since the sanctions were imposed. The supply disruption supported prices temporarily, while India began seeking alternative crude sources, boosting expected exports from Saudi Arabia, Iraq, and Kuwait in December.

Sentiment also improved as the US House prepared to vote on a bipartisan funding bill to end the shutdown, following Senate approval earlier in the week.

Still, analysts cautioned that OPEC+ output growth and robust non-OPEC production would keep markets well supplied. Commerzbank warned that “the oil market will face considerable oversupply next year, maintaining downward pressure on prices.”

Technical View:

From a daily perspective, oil remains range-bound after multiple attempts to break higher. The MACD indicator suggests mixed momentum, with short-term consolidation between $59.30–$61.50 likely to continue. Analysts expect sideways trading until a clear breakout occurs.

Today’s Outlook:

- Strategy: Buy on dips, sell on rebounds.

- Resistance: $62.5–$63.5

- Support: $59.5–$58.5

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.