1. Forex Market Insight

EUR/USD

The dollar fluctuated between small gains and losses, easing slightly after the policymaker, Atlanta Fed President Bostic said he expected six rate hikes this year and two in 2023.

He takes a more dovish stance than most of his colleagues due to the concerns about the impact of the conflict in Russia and Ukraine on the U.S. economy.

But the dollar strengthened and the euro came under renewed pressure after Powell said the Fed must act “quickly” to rein in hyperinflation and would do so with higher-than-usual rate hikes if necessary.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today we focus on the 1.1055-line. If the euro runs steadily below the 1.1055-line, then pay attention to the support strength of the two positions of 1.0986 and 1.0940. If the strength of the euro breaks above the 1.1055-line, then pay attention to the suppression strength of the two positions of 1.1096 and 1.1143.

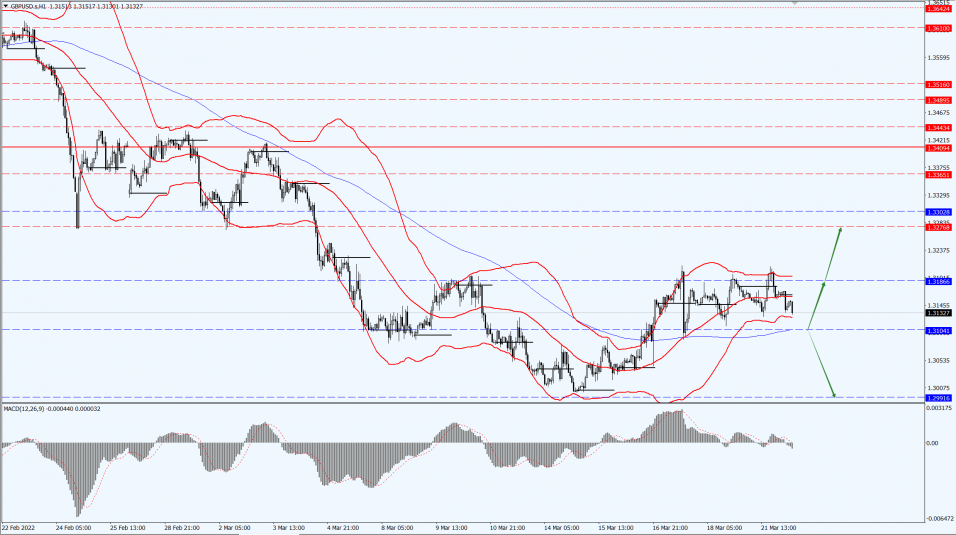

GBP Intraday Trend Analysis

Fundamental Analysis:

Yesterday, 21st March 2022, GBP/USD fell 0.07% to 1.3165, after rising as much as 0.2% during the session on cross-related buying and higher gilt yields.

The focus will be on UK inflation and the Chancellor’s Budget statement on Wednesday, 23rd March 2022.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3104-line today. If the pound runs above the 1.3104-line, it will pay attention to the suppression of the 1.3186 and 1.3276 positions. If the pound runs below the 1.3104-line, it will pay attention to the support strength of the 1.2991-line.

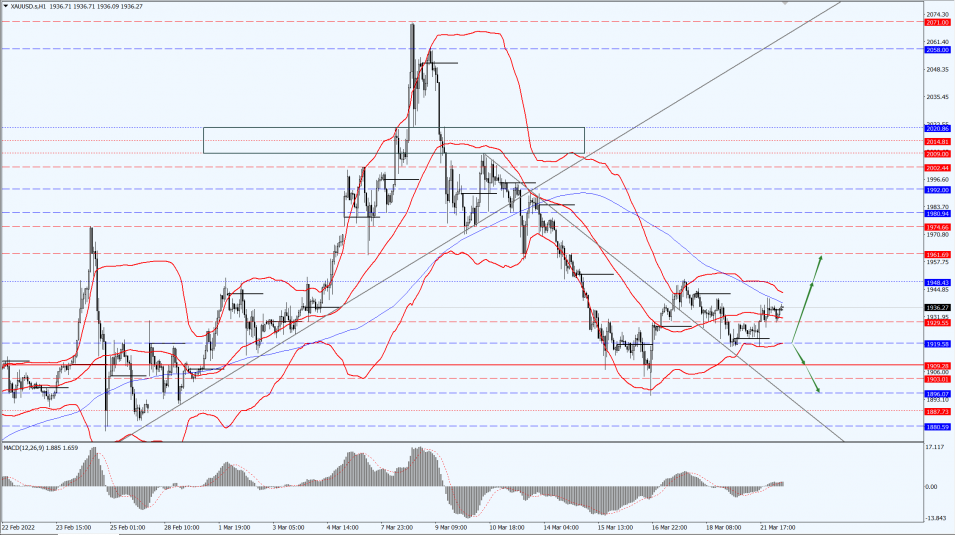

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Rising commodity prices are helping support gold’s appeal as an inflation hedge, while the Russia-Ukraine war has fueled demand for the safe-haven asset.

As a result, inflation expectations are rising and the economic situation may be eased. Meanwhile, real interest rates are still accommodative, so these provide a relatively good bullish environment for gold.

Today’s focus is still the further news on the situation in Russia and Ukraine, as well as speeches from other Fed officials.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1919-line today. If the gold price runs steadily above the 1919-line, then it will pay attention to the suppression of the 1948 and 1961 positions. If the gold price breaks below the 1919-line, it will open up further downside. At that time, we will pay attention to the support strength of the two positions of 1909 and 1896.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, Brent oil rose 7.12% as the third consecutive day of gains and settled at $115.62 per barrel.

With the Russian-Ukrainian conflict showing little sign of abating, the focus has returned to the market’s ability to make up for the blow from Russia’s oil sanctions.

Meanwhile, EU member states will hold a series of summits this week with U.S. President Joe Biden to consider whether to impose an oil embargo on Russia over its invasion of Ukraine, fueling fears that the market is losing supplies of Russian crude.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 107.52-line today. If the oil price runs above the 107.52-line, then focus on the suppression of the 111.95 and 116.30 positions. If the oil price runs below the 107.52-line, then pay attention to the support strength of 102.52 and 99.50.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.