1. Forex Market Insight

EUR/USD

The dollar index fell 0.45% to 99.85 on Wednesday, 13th April 2022, after rising to 100.52 earlier in the session which is its highest level since May 2020, as the euro reversed course from losses before the European Central Bank policy meeting on Thursday, 14th April 2022.

The dollar index has risen nearly 3% so far this month, on track for its biggest monthly gain in nine months. The euro rose 0.54% to $1.0884.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

We focus on the 1.0890-line today. If the euro runs steadily below the 1.0890-line, then pay attention to the support strength of the two positions of 1.0832 and 1.0776. If the strength of the euro breaks above the 1.0890-line, then pay attention to the suppression strength of the two positions of 1.0940 and 1.0986.

GBP Intraday Trend Analysis

Fundamental Analysis:

The U.K. reported an unemployment rate of 3.8 %in the three months to February, the lowest level since 2019. The unemployment rate was 4.3% in March, and jobless claims fell by 46,900.

Despite the strong labor data released on Tuesday, 12th April 2022, relevant indicators showed that the UK labor market remained tight in March, therefore the Bank of England is forecast to have limited room for further interest rate hikes.

With economic demand weakening, the Bank of England is highly likely to pause rate hikes in the second half year of 2022.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2991-line today. If the pound runs above the 1.2991-line, it will pay attention to the suppression strength of the two positions of 1.3104 and 1.3186. If the pound runs below the 1.2991-line, it will pay attention to the support strength of the 1.2872-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold fluctuated in a narrow range yesterday, 13th April 2022, and is currently trading around $1,975.

The price of gold had previously hit a nearly one-month high of $1,981.49 per ounce on Wednesday, 13th April 2022, as U.S. President Biden announced on the same day to provide Ukraine with an additional $800 million of military aid.

This action has heightened expectations of worsening war.

On top of that, rising consumer prices have bolstered gold’s appeal as an inflation hedge.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1980-line today. If the gold price runs steadily below the 1980-line, then it will pay attention to the support strength of the 1961 and 1948 positions. If the gold price breaks above the 1980-line, it will open up further upward space. At that time, pay attention to the suppression strength of the 1992-line and 2002-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

The futures of crude oil rose 3.7% to settle at $104.25 per barrel yesterday, 13th April 2022.

The day before, 12th April 2022, both benchmarks climbed more than 6%.

Meanwhile, oil prices continued to rise as major global trading firms plan to reduce purchases of crude oil and fuel from Russia’s state-owned oil company as early as 15th May 2022, to avoid a conflict with EU sanctions on Russia, sources said.

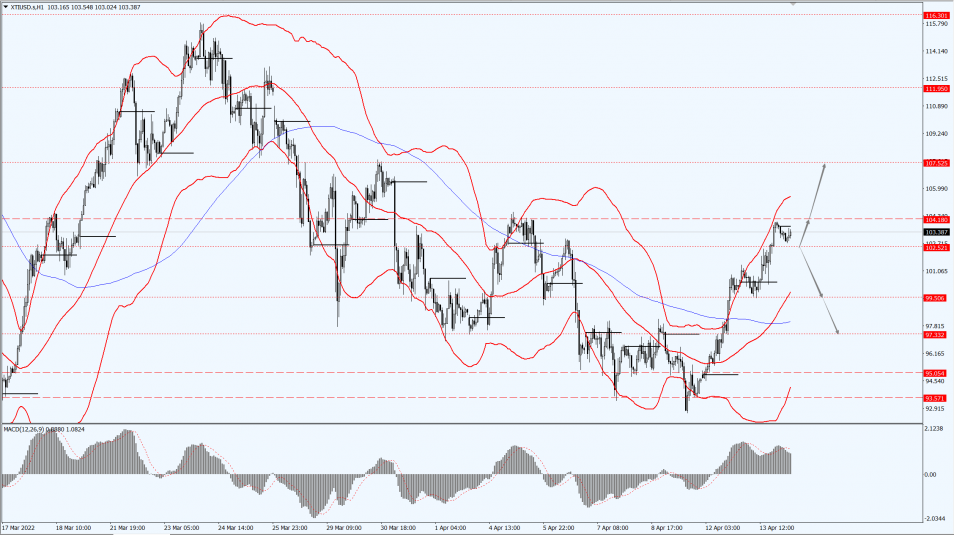

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 102.52-line today. If the oil price runs above the 102.52 line, then focus on the suppression strength of the 104.18 and 107.52 positions. If the oil price runs below the 102.52 line, then pay attention to the support strength of 99.50 and 97.33.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.