US equities have extended their rally into late 2025, with major indices holding near record highs despite elevated valuations, slowing growth signals, and shifting expectations around monetary policy. As markets look ahead, the key question shaping the US stocks outlook for 2026 is whether the current rally can be sustained, or whether it faces new structural tests.

Two forces are increasingly central to this discussion: the direction of interest rates and the potential evolution of market participation. Together, they could play a decisive role in how equities behave in 2026.

US Stocks Outlook 2026: S&P 500 to $8,000?

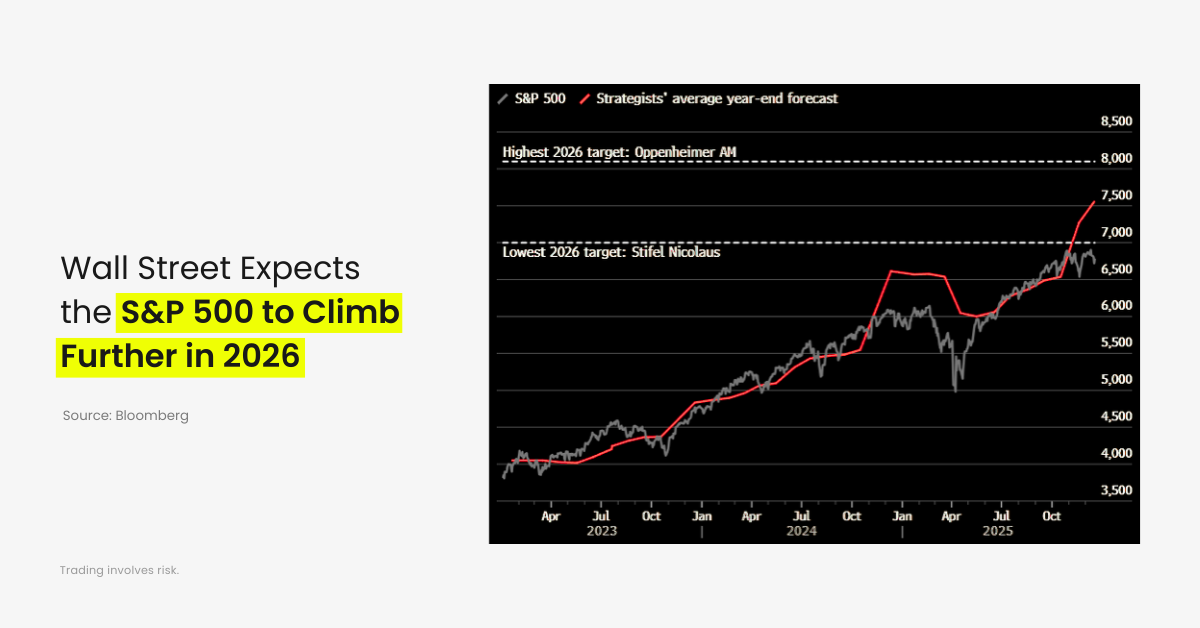

Despite concerns around valuations and late-cycle risks, Wall Street’s baseline outlook for 2026 remains constructive.

According to Bloomberg data, major investment banks and strategists continue to expect the S&P 500 to push higher into 2026, supported by easing financial conditions, resilient earnings expectations, and improving liquidity dynamics.

What the Forecasts Show

- Highest 2026 target: Around 8,000 on the S&P 500, projected by Oppenheimer Asset Management

- Lowest 2026 target: Around 6,500, forecast by Stifel Nicolaus

- Strategists’ average path: Points to continued upside, though at a more measured pace than the explosive gains seen earlier in the cycle

The wide gap between the highest and lowest forecasts highlights an important point: optimism exists, but conviction varies.

Rather than calling for a straight-line rally, most strategists appear to be pricing in:

- Slower but positive growth

- Gradual easing in interest rates

- Higher volatility along the way

In other words, the consensus is less about chasing momentum and more about expecting the trend to remain intact, provided macro conditions do not deteriorate sharply.

This aligns with the broader theme shaping the US stocks outlook for 2026: supportive policy expectations on one side and growing sensitivity to data and earnings on the other.

Interest Rates: Risk or Opportunity for Stocks?

Interest rates remain the most powerful driver of equity valuations.

Markets are currently positioning for lower policy rates over time, particularly if inflation continues to cool and economic momentum moderates. Lower rates tend to support stocks by:

- Reducing discount rates on future earnings

- Improving liquidity conditions

- Encouraging risk-taking across asset classes

Looking into 2026, political and policy uncertainty adds another layer. Changes in Federal Reserve leadership could influence the pace and tone of monetary policy, though outcomes remain uncertain and dependent on economic data. If easing accelerates more aggressively than expected, equities could benefit in the near future.

That said, markets will remain sensitive to whether rate cuts are driven by economic stability or economic stress, as the latter could change the narrative quickly.

Key takeaway: Falling rates can support stocks, but the reason behind those cuts matters.

US Stocks Outlook: S&P 500 Targets 2026

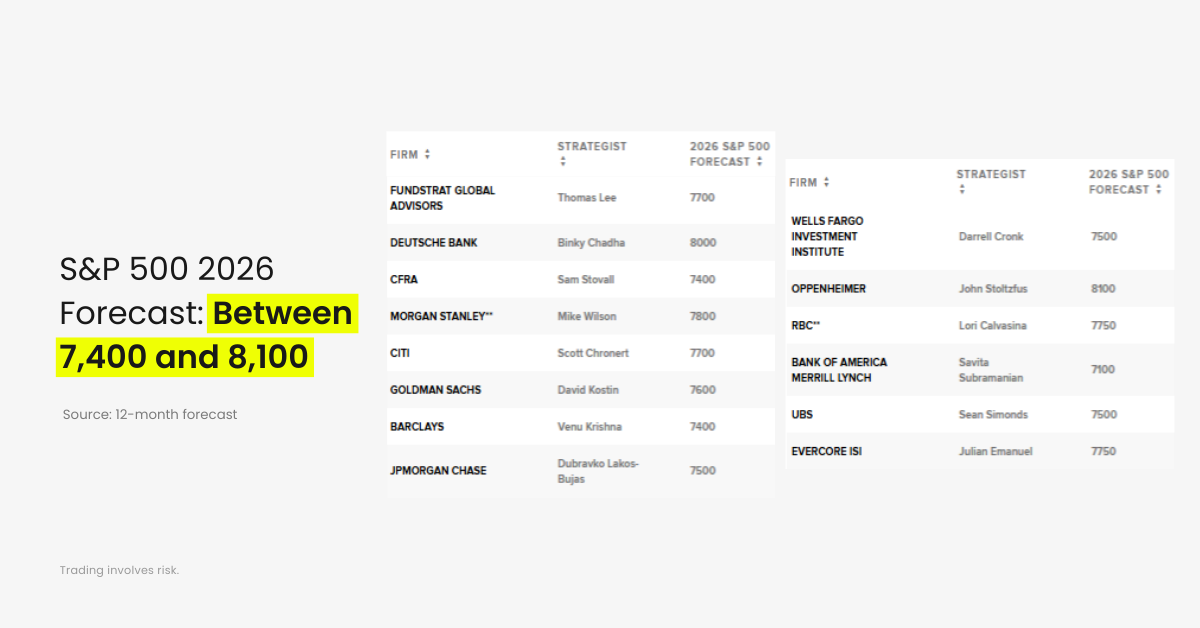

A broader look at Wall Street forecasts reinforces the idea that optimism around US equities in 2026 is not isolated.

According to the 2026 CNBC Market Strategist Survey, most major banks and asset managers expect the S&P 500 to trade meaningfully higher next year, with projections clustering between 7,400 and 8,100.

Notably:

- Oppenheimer sits at the high end with a 8,100 forecast

- Deutsche Bank projects 8,000

- Morgan Stanley, Goldman Sachs, JPMorgan, Citi, and UBS all cluster in the 7,500–7,800 range

Even the more cautious estimates, such as Bank of America at 7,100, still imply levels above current prices.

This suggests strategists are not expecting a sharp valuation reset, but rather a market supported by:

- Gradual rate easing

- Earnings resilience

- Stable liquidity conditions

That said, elevated valuation assumptions also highlight why the path in 2026 may be volatile, even if the broader trend remains constructive.

Stock Selection is Key in 2026

Artificial intelligence continues to anchor market leadership, but 2025 showed that not all AI exposure is treated equally.

In 2026, the market’s main focus are:

- Real revenue generation

- Infrastructure demand

- Earnings visibility

AI Stocks Commonly Watched by Markets

- Nvidia (NVDA) – Core AI compute and data center demand

- Broadcom (AVGO) – AI networking and custom silicon exposure

- Microsoft (MSFT) – Cloud, AI integration, and enterprise adoption

Rather than broad speculation, leadership has narrowed toward companies with established positioning. This trend could persist in 2026 as investors become more valuation-sensitive.

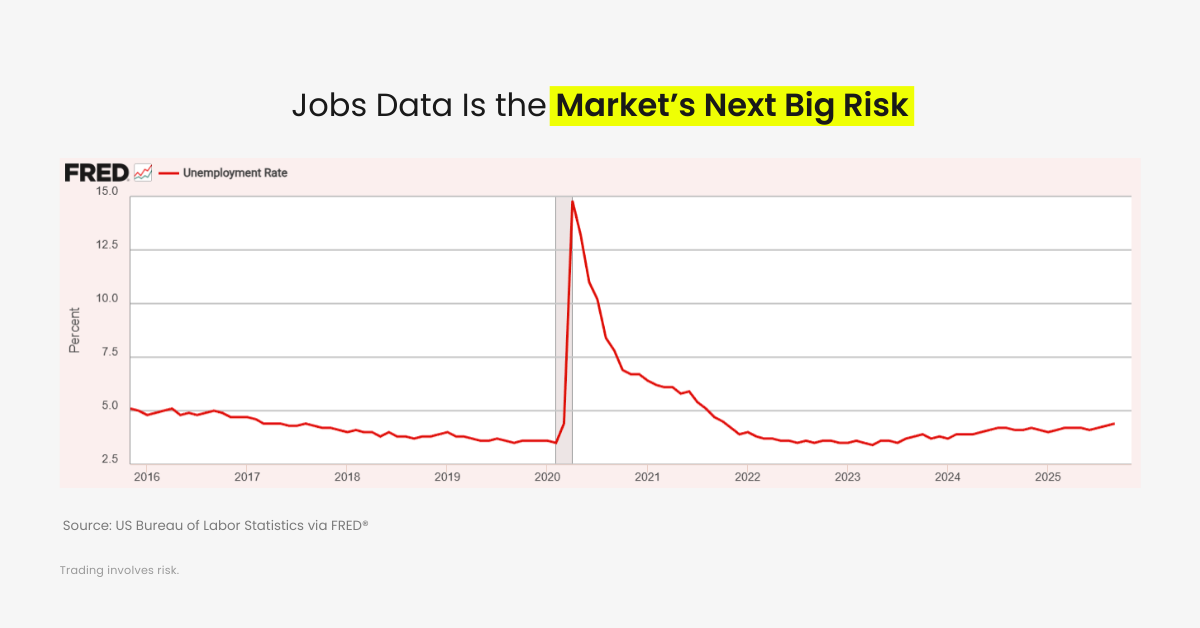

The Main Risk Scenario: NFP Keeps Going Higher

Lower interest rates are not always positive if they arrive for the wrong reasons.

If Non-Farm Payrolls (NFP) data begins to weaken sharply and unemployment rises quickly, rate cuts may be seen as a response to economic stress rather than a supportive policy shift. Historically, periods when the Federal Reserve moved aggressively to ease have often coincided with higher market volatility,

In such environments, equities can struggle even as rates fall, reflecting concerns around earnings, demand, and confidence. This distinction matters for 2026, as markets are likely to respond differently to rate cuts driven by normalization versus cuts driven by fear.

What Traders Will Watch in 2026

As 2026 approaches, attention is likely to center on a small set of decisive factors: the pace and intent behind rate cuts, the ability of corporate earnings to hold up, liquidity conditions, shifts in market participation, and the behavior of volatility.

Rather than a straight-line extension of the rally, the US stock market appears to be moving into a phase where policy guidance, economic data, and positioning play a greater role than momentum alone. How these forces interact will ultimately determine whether the rally remains sustainable or transitions into a more selective and volatile environment.

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial trading or investment decisions.