Gold and silver continue to break record highs, with prices pushing to new all-time highs almost every other week. What started as a steady rally has turned into one of the strongest precious metals runs in decades, drawing attention from both long-term investors and short-term traders.

The big question now is simple:

Can gold and silver continue this trend in 2026, or are prices getting ahead of themselves?

So far, the fundamentals have been supportive. Falling inflation pressures, shifting interest rate expectations, rising geopolitical risks, and growing concerns around fiat currencies have all contributed to strong demand. As markets look ahead to 2026, attention is turning to whether these forces remain in place and whether precious metals can continue adapting to them.

Why Are Gold and Silver Hitting Record Highs?

Gold and silver have benefited from a rare alignment of macro drivers:

- Expectations for Federal Reserve interest rate cuts

- A cooling inflation trend in recent CPI readings

- Signs of softening in parts of the labor market

- Elevated geopolitical and currency-related uncertainty

Together, these factors have reduced the opportunity cost of holding non-yielding assets and increased demand for stores of value outside the traditional financial system.

Will the Fed Cut Rates More Aggressively in 2026?

One of the most searched questions right now is:

“How do interest rate cuts affect gold and silver prices?”

Markets are increasingly focused on the next phase of monetary policy. If inflation continues to ease and employment data shows further cooling, the case for additional rate cuts strengthens.

Lower rates historically create a more favorable environment for precious metals, particularly in the first half of an easing cycle, when expectations adjust faster than policy itself.

What Role Do CPI and Jobs Data Play in the Gold and Silver Outlook?

Inflation and employment remain central to the outlook:

- Lower CPI readings reduce real yields

- Rising unemployment or softer NFP trends increase pressure on central banks to ease

If these trends persist, gold and silver may continue to reflect expectations well before policy changes are fully implemented.

What the Gold-to-Silver Ratio Is Signaling

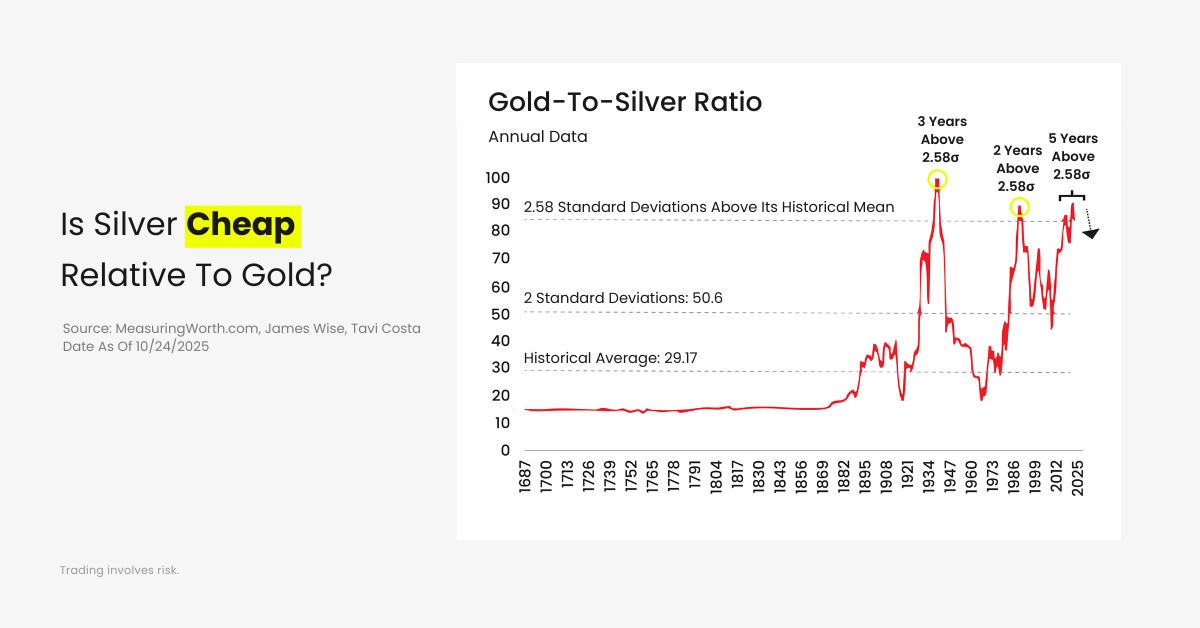

The chart above shows the gold-to-silver ratio, which measures how many ounces of silver are needed to buy one ounce of gold. Historically, this ratio has averaged much lower than where it stands today.

When the ratio is high, it typically indicates that silver is relatively cheap compared to gold.

When the ratio is low, silver is considered relatively expensive.

At current levels, the ratio remains well above its long-term historical average and has spent extended periods more than two standard deviations above the mean. That positioning suggests silver has lagged gold over time rather than keeping pace with it.

Importantly, this does not guarantee a move in either direction. Instead, it highlights a relative valuation imbalance that markets often monitor when assessing precious metals dynamics.

Historically, periods of elevated ratios have coincided with:

- Stronger safe-haven demand for gold

- Delayed participation from silver

- Higher volatility once silver begins to respond

As gold continues to trade near record highs, the ratio implies that silver has not yet fully reflected the same degree of demand. Whether that gap narrows depends on macro conditions, monetary policy expectations, and shifts in investor behavior.

How High Could Gold and Silver Go in 2026?

Rather than fixed forecasts, markets tend to think in scenarios.

If rate cuts accelerate, inflation stays contained, and global uncertainty remains elevated:

- Gold trading in the $5,000–$6,000 range becomes a scenario some analysts consider plausible over time

- Silver moving toward $100 is often discussed in the context of historical volatility, supply constraints, and ratio normalization

These are not guarantees, but reflections of how markets have behaved during previous late-cycle and easing environments.

What Could Change the Outlook in the Second Half of 2026?

The first half of 2026 appears more supportive based on current conditions. Beyond that, several variables could shift the narrative:

- Faster-than-expected economic stabilization

- A reversal in inflation trends

- Changes in central bank communication

- Shifts in risk appetite across global markets

As always, precious metals respond to expectations, not just outcomes.

So, Gold & Silver Bullish or Bearish for 2026?

At this stage, the balance of factors continues to lean constructively for gold and silver, particularly early in the year. However, as with any macro-driven trend, conditions can evolve quickly.

Rather than a straight line higher, 2026 is likely to be shaped by policy signals, data trends, and shifting confidence, with gold and silver remaining highly sensitive to each.

Risk Disclosure

Trading in Securities, Futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions. This blog may contain speculative statements regarding future expectations, plans, or projections based on information and assumptions currently available to D Prime. Although D Prime considers these assumptions reasonable, such statements involve risks, uncertainties, and factors beyond D Prime’s control, and actual outcomes may differ significantly.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness or reliability of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial,trading or investment decisions.