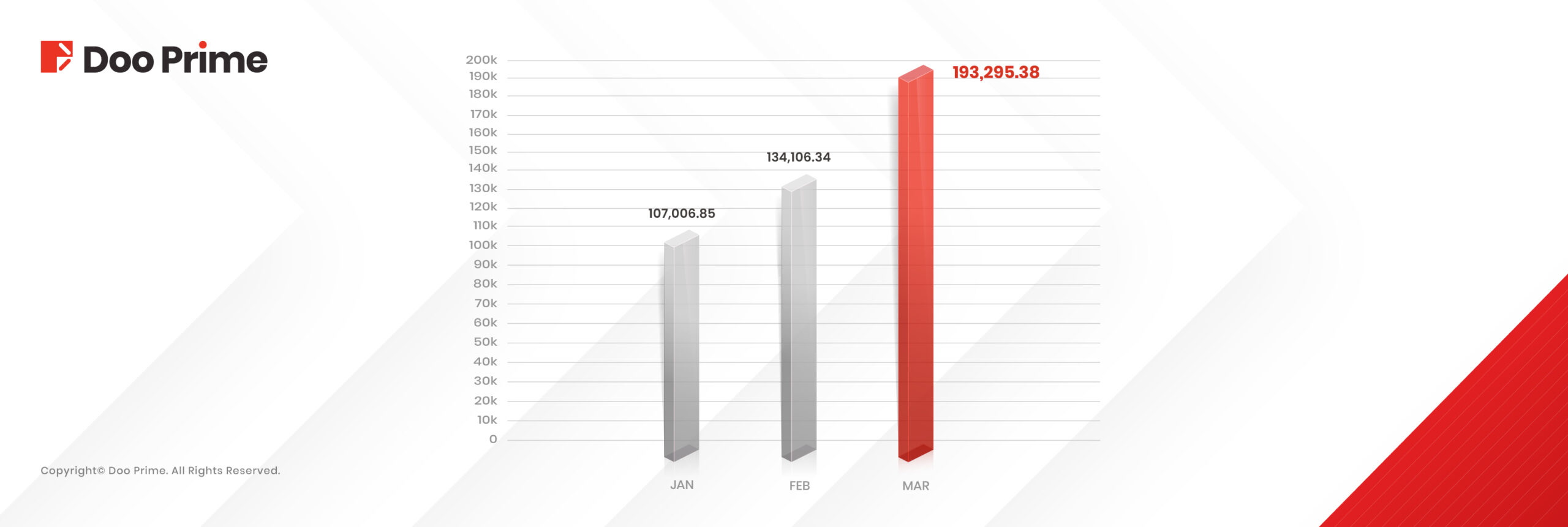

We are proud to share our March 2025 trading volume report, highlighting a strong surge in trading activity and sustained platform growth. With global markets in flux, clients actively engaged with top-performing instruments across forex and commodities, resulting in one of our strongest months to date.

March 2025 Trading Highlights

- Total Trading Volume: USD 193.30 billion

- Average Daily Volume (ADV): USD 6.24 billion

- Month-on-Month Growth: +44.14%

- Year-on-Year Growth: +102.27%

Top Traded Products

In March, the most actively traded instruments included XAU/USD, which recorded the highest overall volume with a 30.09% increase. USD/JPY maintained its position as the second most traded instrument for the second consecutive month, showing a significant rise of 187.08%. Other actively traded pairs included EUR/USD and GBP/JPY. Notably, GC_2504 (CME Gold Futures CFD) experienced the fastest growth among all instruments, surging by an impressive 442.12% compared to February.

Market Trends Driving Activity

March’s trading momentum was significantly influenced by heightened global market volatility. The announcement and implementation of new US tariff measures by President Donald Trump triggered increased risk aversion and sharp movements across multiple asset classes.

With markets on edge and reciprocal tariffs expected in early April, investors turned to safe-haven assets, pushing XAU/USD past the USD 3,000 mark by the end of the month. Gold prices rose 19% in Q1 2025, marking the strongest quarterly performance since 1986.

Meanwhile, the forex market saw intensified activity, particularly in EUR, JPY, and GBP pairs. USD/JPY maintained strong momentum, while GC_2504 experienced the largest monthly growth among all listed instruments.

Continued Growth, Consistent Delivery

Doo Prime’s trading platform supported this surge in activity with stable execution, competitive pricing, and seamless access to the global markets. The 102.27% year-over-year growth in trading volume highlights not only favourable market conditions, but also the increasing trust and participation of our global client base.

Despite global uncertainties, March demonstrated that volatility continues to bring opportunities. Doo Prime remains focused on delivering a high-performance, secure, and efficient trading experience.

Our focus remains on providing stable, fast, and transparent access to the markets so clients can trade with confidence, even during periods of high volatility.

Risk Disclosure

Trading in securities, futures, contracts for difference (CFDs) and other financial products carries high risks due to the rapid and unpredictable fluctuation in the value and prices of these financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases and other unforeseen circumstances. You may sustain substantial losses, including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before you begin to trade or engage in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

The information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at any time without notice and does not consider any specific recipient’s investment objectives or financial situation. Past performance is not an indicator of future performance and D Prime and its affiliates give no assurance that any views, projections or forecasts will materialize. D Prime and its affiliated entities make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.